Europe’s new vehicle registrations reached their highest level last year since the pandemic. Strong demand for battery electric vehicles (BEVs) and the growing influence of new market entrants sparked significant shifts in the continent’s automotive landscape with new passenger vehicle registrations totalling 12,792,151 units in Europe-28 in 2023, up 14% on the previous year, according to JATO.

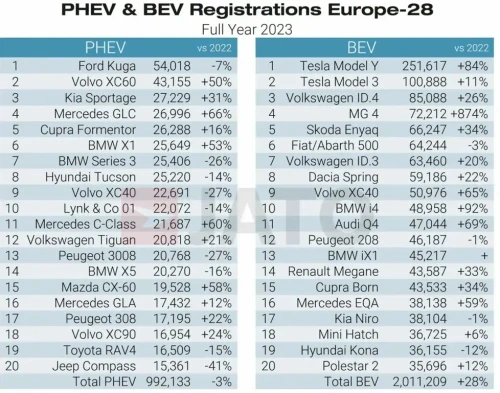

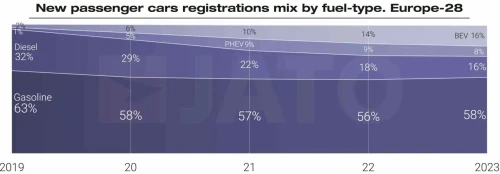

Much of the growth in Europe’s new car market in 2023 was driven by BEVs, which accounted for 15.7% of total market share with 2,011,209 units registered. This marks a new high for the category, almost equalling the 2,049,157 registrations of diesel cars. These results cement Europe’s status as the world’s second largest market for BEVs, behind China (~5 million units) but ahead of the US (1.07 million units).

Although growth stalled in November and then fell sharply in December, incentives are continuing to support BEV uptake across Europe. But when looking at the data by registration type, it becomes clear that incentives are only currently appealing to companies, fleets and rentals.

—Felipe Munoz, Global Analyst at JATO Dynamics

Growth was driven by strong demand for new vehicles in markets including the UK, France, Italy, Spain, Belgium, Portugal, Croatia and Cyprus. However, the impact of high interest rates could be seen in Germany, which remains the largest market for new vehicles in Europe.

According to data for 27 markets, BEV registrations made by fleets and businesses rose by 51%, compared to a 4% rise for private buyers. Notably, only 39% of overall BEV registrations were made by private buyers, down nine points from 2022.

The lack of interest from private buyers is a major hurdle for the industry to overcome. Sales to private individuals tend to be the most profitable for carmakers, and so it’s imperative that they do more to attract this type of customer.

—Felipe Munoz

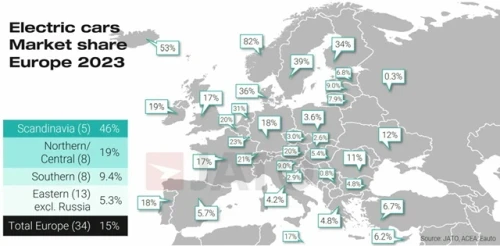

BEVs gained market share fastest in Finland, Denmark, Belgium, the Netherlands, and Luxembourg, rising from an already strong base in these markets. Strong growth was also recorded in markets where BEVs have a small market share, such as Slovenia (5.0% in 2022 to 9.0% in 2023), Estonia (3.4% to 6.8%) and Latvia (6.6% to 9.0%). By contrast, market share for BEVs in Croatia dropped from 3.2% in 2022 to 2.9% last year. The UK market remained stable, with a slight drop from 16.6% in 2022 to 16.5% in 2023, while minor growth of 0.5 points was recorded in Italy.

Regionally, Scandinavia leads Europe by a significant margin with BEVs representing 46% of the total market, followed by Northern and Central Europe (19% market share), Southern Europe (9.4%) and Eastern Europe (5.3%).

The shift to BEVs is taking place at four different speeds.

—Felipe Munoz

Tesla continued its extraordinary ascent up the brand rankings. The eighteenth most-registered brand in 2022, it has now leapfrogged Nissan and Volvo, rising to sixteenth place. The US manufacturer registered 362,300 units in 2023—up 56% year on year—giving the brand a record market share of 2.83%, up from 2.06% in 2022.

Tesla was the biggest market share winner within the BEV segment, followed by SAIC (MG), BMW Group, Toyota and Mercedes-Benz. By contrast, Renault Group, Stellantis, Hyundai Motor Company, Nissan and Ford posted the biggest market share losses within the BEV segment.

The Tesla Model Y became Europe’s most-registered model in 2023—both the first time a non-European model and an electric model have led the rankings—and is the best-selling vehicle in markets including Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland.

The Volkswagen Group held the largest market share in Europe in 2023, rising to 25.8% from 24.7% in 2022. Audi, Skoda, Seat and Cupra all gained market share last year—a result of their strong EV line-ups and attractive deals for older models such as the Audi A4, A1, and Q2 and the Seat Ibiza. Skoda’s Octavia and Kamiq, Audi’s Q4, Seat’s Ateca and Cupra’s Leon also posted strong results. Despite growing its overall market share, registrations of the VW Golf only increased by 4%, while the T-Cross saw a 5% drop.

Volkswagen Group’s electric line-up performed well in 2023 with the ID.4 and the ID.3 in third and seventh place respectively in the BEV rankings. However, these models were outperformed by direct competitors including the Tesla Model Y and the MG 4. The Model Y outsold the ID.4 by almost three times, despite boasting an average retail price 15% higher than the Volkswagen model. The MG 4 also outsold the ID.3 by 8,800 units, despite its average retail price being 5% higher than the ID.3 in Germany.

A major change in the European automotive landscape in 2023 was the continued penetration of Chinese car brands. Seven new brands entered the market last year, joining the 23 brands already available in 2022. Overall, Chinese brands registered 321,918 units in 2023, up 79% year on year.

Only eight of the 30 Chinese brands available in Europe registered more than 1,000 units, and MG accounted for 72% of the total. The brand—founded in the UK but now under the ownership of China’s SAIC Motor—saw volumes more than double from 113,182 units to 231,818 units last year to achieve a market share of 1.81%, meaning it is now the twentieth best-selling brand in Europe. MG outsold Cupra, Suzuki, Mini and Mazda, and was less than 14,000 units behind Spain’s Seat in the overall rankings.

Source from Green Car Congress

Disclaimer: The information set forth above is provided by greencarcongress.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.