The U.S. Customs Border Protection agency (CBP) has implemented electronic and physical customs clearance procedures to provide a rapid and efficient clearance process. CBP encourages importers and exporters to be familiar with the processes and documents required for import and export.

This article explains the process and documents that you will need to expedite your shipment import or export.

Table of Contents

Imports

Exports

Summary points

Imports

CBP provides importers with the ability to submit their customs declaration electronically in advance of the shipment physically arriving at the port of entry. The intention is for the goods to clear customs and be onforwarded quickly and efficiently. Goods are cleared typically within 24 hours of customs processing, unless there are customs concerns with the shipment that warrant physical inspection or the involvement of a government partner agency.

In principle, an importer can file the customs declaration with customs as soon as the documents are ready, although CBP will not process the declaration for clearance immediately. For ocean shipments, the documents will not be processed until five days before the shipment’s arrival. For air shipments, the documents will not be processed until the aircraft is directly en route to the US and has physically taken off (“wheels up”).

The process for electronic submission is:

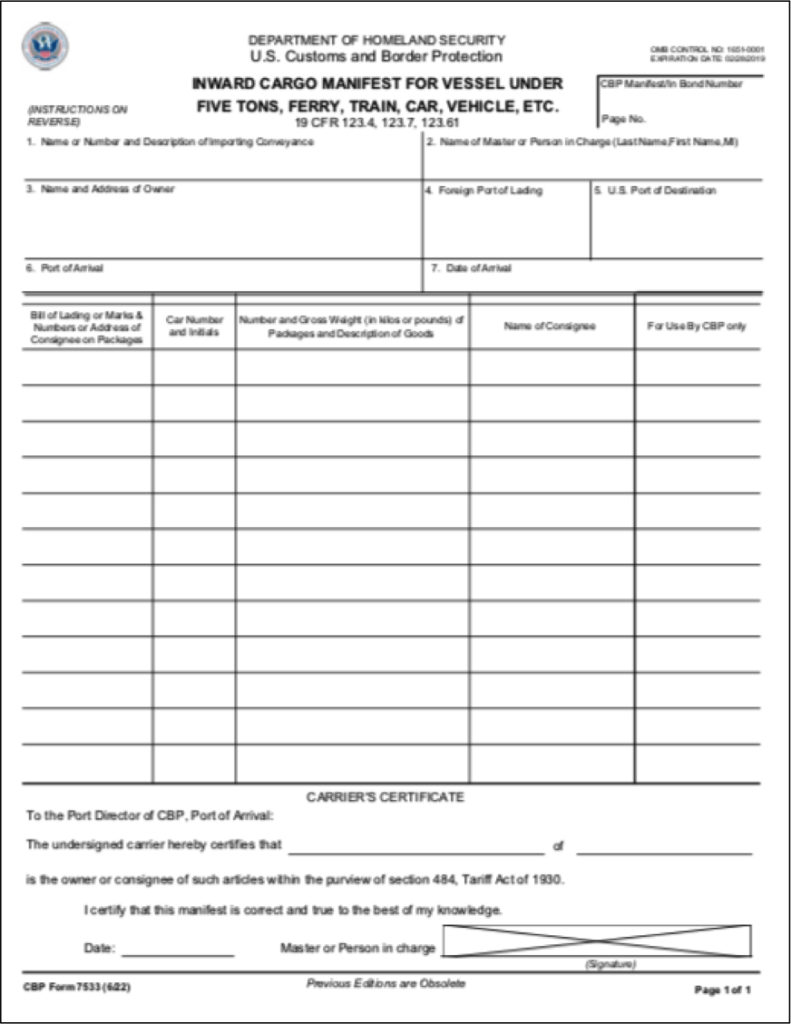

- Importer will upload Entry Manifest (CBP Form 7533) and supporting documents, or Special Permit for Immediate Delivery (CBP Form 3461)

- CBP will release or will mark as hold for inspection

- Importer will file the Entry Summary form (7501)

- CBP will forward the invoice for the import duties owed

Import Security Filing (CBP Form 7533)

CBP requires that an importer files all shipment entry pre-alert documents within 15 calendar days of the date that a shipment is due to arrive at the U.S. port of entry. The required documents are:

- entry manifest (CBP Form 7533)

- commercial invoice

- packing lists

- certificate of origin

- inspection certificate(s)

- other documents as necessary

Following electronic declaration of the Customs entry, if Customs has any concerns with the imported goods they will be marked for inspection on arrival. There are different levels of examination that might be completed, and there may be several conducted at one time.

For example, a complete shipment container could go through an x-ray exam to verify the goods within the container. In a tailgate exam, CBP opens the back of the container, the tailgate, and will do a visual inspection of some of the items. In a partial exam, CBP will select a few boxes or cartons at random and inspect the goods. In an intensive exam, CBP will request that some shipments move to a CBP-approved warehouse, where all items will be inspected. This can take one week or more.

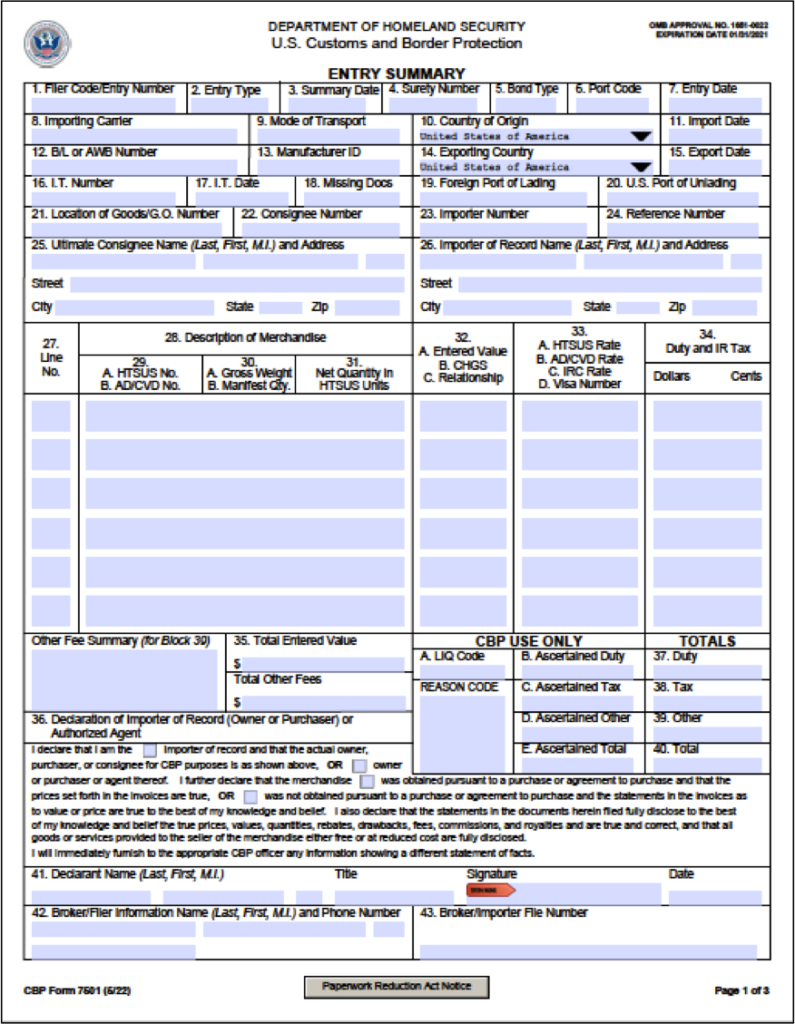

When the shipment is released from CBP, a Customs Entry Summary form 7501 must then be filed, and the estimated duties deposited at the port of entry.

Customs Entry Summary (CBP Form 7501)

Once the shipment is released, the Entry Summary form 7501 is filed. Estimated duties are deposited within 10 working days of the shipment entry at the designated customs office. The Entry Summary includes:

- shipment is release and returned to the importer, or authorized agent

- Entry Summary form 7501 is completed and submitted

- other invoices and documents to be submitted as necessary to assess duties and satisfy all import requirements

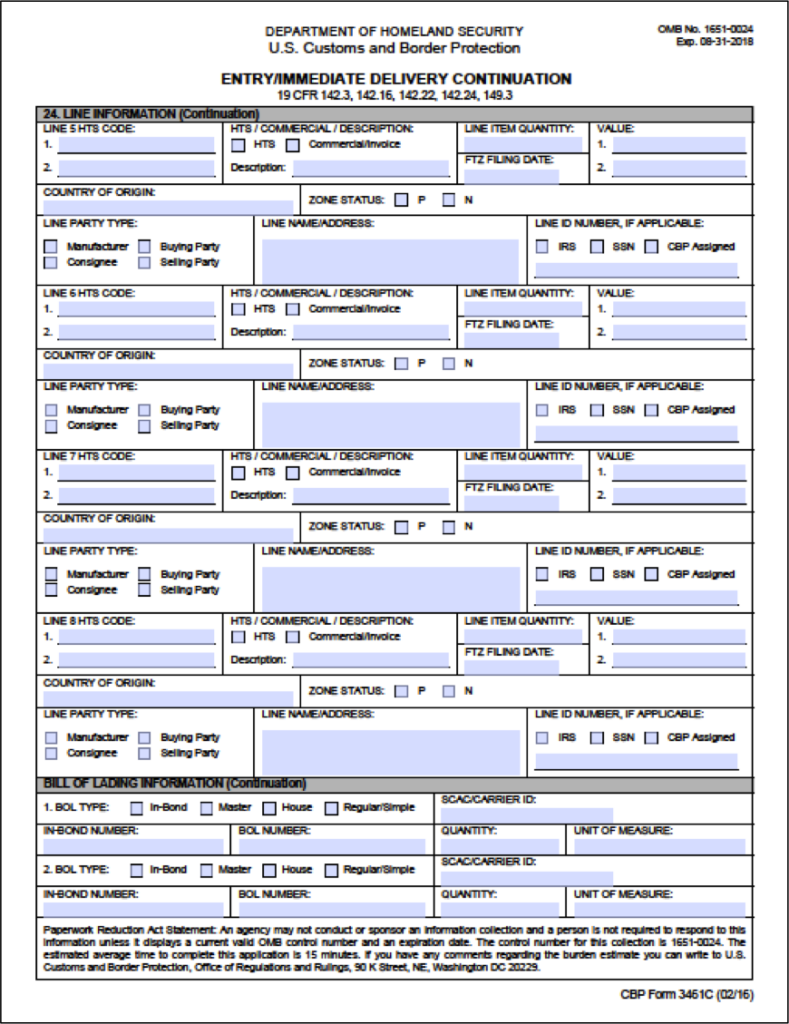

Special Permit for Immediate Delivery (CBP Form 3461)

There is an alternate procedure, limited to certain commodities, that provides for immediate release of a shipment prior to arrival of the goods. The importer may apply for a Special Permit for Immediate Delivery using CBP Form 3461. Carriers participating in the Automated Manifest System (AMS) can receive a conditional release authorization for the shipment once they have left the origin country, up to five days before landing in the U.S.. If the application is approved, then once the shipment arrives at the port of entry it will be released promptly.

An Entry Summary form 7501 must then be filed, either hard copy or electronically. Duties are then estimated and must be deposited within 10 working days of release.

Exports

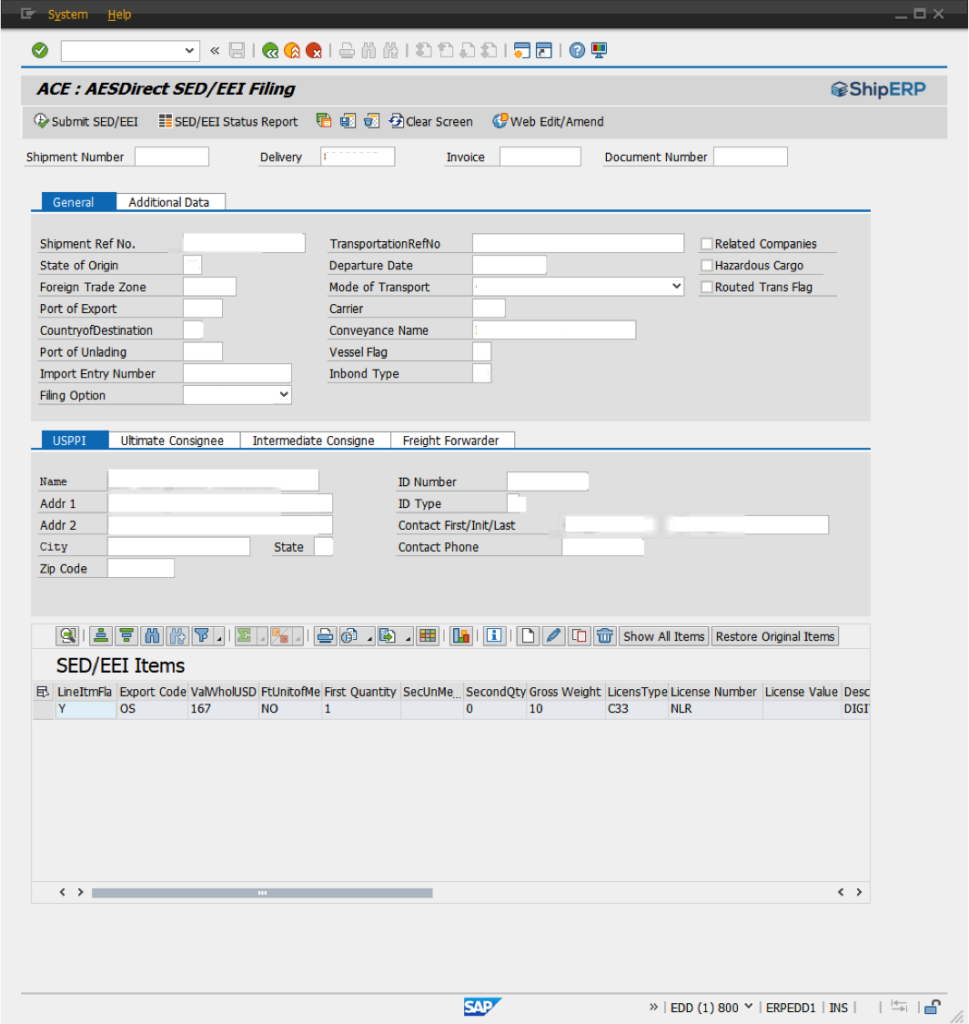

The U.S. CBP developed the Electronic Export Information and Automated Export System to maintain electronic records, to track, control, and process all goods exported from the U.S. The Automated Export System (AES) is the electronic system that collects the information on goods intended for export. The Electronic Export Information (EEI) is the actual data on exports to be filed in the AES. The EEI could be submitted in paper form.

Electronic Export Information (EEI)

The exporter is responsible for preparing the EEI data, and the carrier submits it to CBP using the AES. The EEI data needs to be filed on the AES system when the value of the commodity (as classified by the Schedule B number) is over $2,500, or if an export license is required for the commodity.

The exporter will need to apply for a Schedule B number for the commodity they intend to export. This is a 10 digit export code obtained from the U.S. Census Bureau, required for exporting goods out of the U.S., and used by the U.S. Census Bureau for export statistics.

The Schedule B number must be reported in the Automated Export System (AES), to identify the goods being exported.

Automated Export System (AES) filing

AES is a centralized system used by CBP for gathering and processing export information electronically instead of in paper form. Export shipment details are filed electronically to CBP, and all data is accessible by multiple U.S. government agencies. The system is in operation at all ports across the U.S., and available for all modes of shipping.

Once the exporter (or their agent) has made shipping arrangements with the carrier, the exporter then transmits the commodity and export information to CBP using AES. The AES system automatically validates the commodity information, and checks for any other requirements or licenses against other government agencies data. AES then generates either a confirmation message or an error message back to the exporter. Any errors must be corrected and the entry resubmitted.

Summary points

When shipping into or out of the U.S., it is important to know the Customs forms and electronic systems required, what systems to register for in advance, and what identification numbers to have set up. The processes and systems have all been set up to expedite the shipping processes for importers and exporters.

For import, CBP specifies the forms that should be completed, and these can be filled out manually or completed online. For export, the information can be manual or electronic, but shippers are encouraged towards the electronic (EEI) and to submit using the AES system. If you are unfamiliar with the forms and systems, you can engage the services of a customs broker who can submit the information on your behalf.

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.