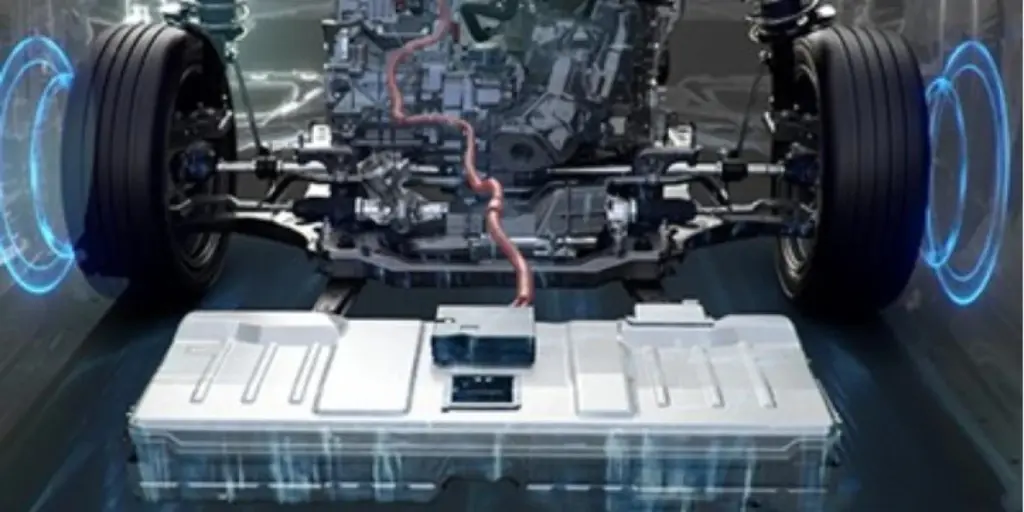

Vehicle makers are taking steps to address future supply chain challenges associated with electrification. As the auto industry eyes the transition to a much more electrified future, it is becoming increasingly clear that supply chains will have to change from current set-ups. This process of change will take a number of forms all along the automotive value chain, from the extraction of necessary raw materials for batteries, to the manufacturing of EV components, the activities and structure of established automotive suppliers and the level of vertical integration of the vehicle manufacturers (OEMs) themselves. In the automotive industry’s elongated and complex supply chain – and one notorious for its lack of transparency – it is going to be a big challenge for all participants. At the OEM level, vehicle makers are taking significant steps to prepare for much bigger powertrain battery needs. Major investments in manufacturing capacity are being planned, sometimes strategically positioned with partners and sometimes kept in-house. As ever, there is a judgement call on the trade-off between sharing cost and intellectual property with a synergistic partner and keeping more control of future operations in-house. The power relationships and problematic supply chain pinch-points of the future have yet to be determined – but they will be substantially formed over the next five years. No time to waste.

Can China be caught in BEV race?

China produced almost two thirds of all global BEVs in 2022 but the race may not yet be over as there is scope for others to make up ground. China has taken an early and substantial lead in becoming a battery electric vehicle (BEV) manufacturing superpower. In a distant second place is Europe followed more closely by North America, accounting for 17% and 11% of global BEV build in 2022, respectively. Given these figures you would be forgiven for thinking the lead is insurmountable and the race is already over – China has won. However, the industry is still in its infancy with BEV volumes making up just 9% of all light vehicle output last year, leaving scope for the other regions to make up ground. China has built this lead, in part, by handing out more than CNY300 billion (US$43.5 billion) in purchasing subsidies and tax breaks from 2009 to 2022 to support locally produced BEVs regardless of whether they are domestic or foreign-owned brands. The government has also offered large procurement contracts to buy products from budding BEV companies, which, in turn, has helped to keep them afloat in their early years as well as fund further R&D. For example, while the rest of the world championed lithium nickel manganese cobalt (NMC) batteries, Chinese firms were able to develop lithium iron phosphate (LFP) battery technology thanks to government support, improving energy density while offering a safer and cheaper alternative to NMC.

Nissan aims high

After a difficult year (FY2022 ended March 31) notable for supply shortages, Nissan has posted annual financial results that exceeded its expectations. Recently, sales have also been lifted by an easing of the global semiconductors shortage. For the full fiscal year, consolidated net revenue was 10.6 trillion yen (8.4 trillion yen FY2021), resulting in an operating profit of 377.1 billion yen (247.1 billion yen FY2021) with an operating margin of 3.6% (2.9% previous year). Net income was 221.9 billion yen (215.5 billion yen previous year). The fiscal year also marked Nissan’s return to positive free cash flow and operating profit for the automotive business. In the fourth quarter of Nissan’s fiscal year (ended 31 March, 2023), revenue was up, year-on-year, by 36% to 3 trillion yen, with operating profit up 56% to 87.4 billion yen. Nissan sees operating profit this year (FY2023 ending 31 March 2024) rising to 520 billion yen (+38% on FY2022) and revenues up to 12.4 trillion yen (+17%). Nissan expects to sell more cars in North America and Europe as those markets expand (see below chart). In the last quarter, overall Nissan global sales were up 23.5% to 745,000 units. Nissan sales in North America were up 26.4% to 335,000 units and Europe sales were up 29.7% to 97,000 units.

Zero CO2 tyre factory

Finnish tyre maker Nokian Tyres has broken ground for a new tyre factory in Romania. Big deal. What makes this one more interesting is its claimed zero CO2 emissions. Production is set to start late in 2024 with full scale output planned for 2025. Due to its location in a prominent regional and European transportation hub, the primary focus of the new factory will be supplying Central Europe. Jukka Moisio, president and CEO of Nokian Tyres, said “energy used at the factory comes from renewable sources and steam needed for the tyre manufacturing process is generated fully without fossil fuels. The site location in Romania supports the target as we can use green energy produced near the site.” Initial annual capacity is for 6m tyres with the main emphasis on passenger vehicle and SUV tyres with larger rim sizes.

China sales resurgence

New vehicle sales in China rebounded 83% to 2,159,000 in April 2023 from extremely depressed year earlier sales of 1,181,000 units when the government implemented widespread Covid lockdowns across the country, according to passenger car and commercial vehicle wholesale data from the China Association of Automobile Manufacturers (CAAM). Economic activity picked up momentum in the first quarter of 2023 with GDP growth accelerating to 4.5% after plunging to a multi decade low of 3% in 2022. Full year growth is forecast to return to above 5% in 2023, despite an expected global economic slowdown. Sales in the first four months of the year were up 7% at 8,235,000 units from 7,691,000 in the same period a year earlier, reflecting a 35% drop in January, with sales of passenger vehicles rising 7% to 6,949,000 units while commercial vehicle sales were up 9% at 1,286,000 units. Sales of new energy vehicles (NEVs) more than doubled to 636,000 units in April and by 43% to 2,222,000 units year to date (YTD). Deliveries of BEVs increased 31% to 1,623,000 units YTD while sales of hybrid vehicles surged 89% to 599,000 units. Vehicle exports jumped 89% to 1,370,000 units YTD while overall vehicle production increased 9% to 8,355,000 units, helped by improving supplies of semiconductors after last year’s supply chain disruption.

Hyundai India expansion

Hyundai Motor Company this week announced plans to invest INR200bn (US$2.4bn) to strengthen its operations in India, the world’s third largest vehicle market after China and the US. The automaker’s local subsidiary, Hyundai Motor India (HMIL), plans to build an assembly plant for electric vehicle (EV) battery packs in Chennai, Tamil Nadu state, where its existing vehicle manufacturing operations are based. The funds will also be invested in existing factories for the production of EV models as well as new internal combustion engine (ICE) vehicles for sale locally and for export. HMIL managing director Kim Un-soo said: “The long term investments will help enhance our manufacturing capacity, enabling us to make the best EVs and ICE vehicles in Tamil Nadu for the rest of the world.” India is one of the fastest-growing automotive markets worldwide, with 4.7m new vehicles sold last year, surpassing Japan. Hyundai is India’s second largest carmaker, behind Maruti Suzuki, with a market share of around 15%. The company has two vehicle plants in Chennai with combined capacity for 775,000 vehicles per year. The investment is expected to increase this to 850,000. Earlier this year, Hyundai agreed to acquire General Motors’ redundant vehicle assembly plant in Talegaon, Maharashtra state, to add further capacity in the country. Before its closure the Talegon facility had capacity for 130,000 vehicles per year at full swing.

Protestors hit VW AGM

Volkswagen’s annual shareholder meeting this week was disrupted by activists protesting about its factory in Xinjiang, western China. Approximately 10 activists entered the meeting, with one throwing cake towards Wolfgang Porsche, chairman of Porsche SE, and the company’s supervisory board chairman Hans Dieter Poetsch. It was understood the activists called for Volkswagen to conduct an external audit of its plant in Xinjiang. There are numerous concerns from the United Nations and Amnesty International over alleged “serious” human rights violations against Uyghurs and other Muslims in this region. Volkswagen has defended its Xinjiang plant and has consistently stated it has found no evidence of human rights violations at its plant. In a visit to the plant earlier this year, Ralf Brandstaetter, chief of VW’s China’s operations said: “Of course we are aware of the critical reports, we take this very seriously. But we have no evidence of human rights violations at this plant – that has not changed after my visit.”

Toyota eyes profit rise

Toyota is planning a 10.1% rise in operating profit to three trillion yen in the fiscal year ending March 31, 2024. The projected rise follows a decline in profit in the year ended 31 March caused by sharply rising costs, swap valuation losses and the cost of terminating Toyota’s business in Russia. Costs for the company were up by 525 million yen with consolidated operating profit overall down to 2,725 billion yen from 2,996 billon yen in the previous year. However, revenues in the year were up 5 trillion yen to 37,154 billion yen, helped by big currency effects. Toyota said the ratio of electrified vehicles in its 2023 fiscal year (ended 31 March 2023) was up to 29.6% (28.4% previous year) on overall sales of 9.6 million units. Toyota president Koji Sato said that the operating result was achieved despite the severe business environment and soaring materials prices. He also outlined a push to electric vehicles for the company. “When it comes to battery electric vehicles, or BEVs, which are especially rapidly progressing, we have set a pace of selling 1.5 million units by 2026 as our ‘base volume,’ and we plan to launch 10 models ranging from luxury vehicles to compacts and commercial vehicles, mainly in the United States and China.

Fisker cuts forecast

Fisker has lowered its 2023 production target in what Reuters said was the latest sign US electric vehicle startups were struggling to ramp up output in the face of supply chain constraints, easing demand and a tight cash position. The news agency noted that followed a report of weak earnings and a production outlook cut from Lucid Group. Reuters said US EV startups’ hopes of shaking up the industry have collided with rising interest rates and sluggish demand, with many grappling with production challenges. Even market leader Tesla has cut prices to boost demand.

SAIC boosts Indonesia investment

SAIC-GM-Wuling has signed a memorandum of understanding (MoU) with the Indonesian government to increase investment in its local subsidiary SGMW Indonesia to target growing regional demand for electric vehicles (EVs), according to reports in China. SAIC-GM-Wuling, a three-way joint venture between SAIC Motor, GM China and Liuzhou Wuling Motors, already has a local production plant, a 120,000 units a year factory just east of Jakarta completed in 2017. It produced 30,000 vehicles last year, including 8,400 battery powered Air mini EVs, making it by far the best selling EV model in Indonesia.

Japan recovery continues

Japan’s new vehicle market continued to recover in April 2023, with sales rising by almost 17% to 349,592 units from weak year earlier sales of 299,620 units, according to the Japan Automobile Manufacturers Association (JAMA). This was the eighth consecutive month of growth, helped by improved semiconductor supplies, compared with last year, which enabled key automakers to reduce order backlogs. The economy was estimated to have grown by a seasonally adjusted 1.5% in the first quarter, driven by7 higher consumer spending, fixed investment and exports. The OECD earlier this year revised upwards its economic growth forecast to 1.8% for 2023, and 0.9% in 2024, with government fiscal policy expected to underpin household consumption. Sales grew 16% to 1,731,150 units year to date (YTD) after declining 16% to 1,496,849 a year earlier, with passenger vehicle sales rising 17% to 1,443,619 while truck sales rose 9% to 284,654 units. Sales of buses and coaches surged 27% to 2,877 as the segment rebounded from the pandemic lows.

Daihatsu in trouble

Toyota has halted sales in Thailand of a model that was found to have been subject to a rigged safety test by its affiliate Daihatsu. Toyota officials in Thailand have reportedly blamed pressures during the development of the Ativ model and insisted that the vehicles in use are safe. Toyota is said to be working with the Thai government to resume sales. Toyota’s CEO for the Asia region, Masahiko Maeda, told reporters that there was pressure at the development site and that the vehicle’s relatively large size may have posed a challenge to small car specialist Daihatsu. Toyota and Daihatsu disclosed last month they were investigating how part of the door in side-collision safety tests carried out for some 88,123 cars had been changed for the purpose of side-on crash safety testing.

BYD to build in Vietnam?

BYD has reportedly decided to add a new manufacturing plant in Vietnam, according to media reports. It would be the Chinese company’s second ASEAN plant. Local media cite government sources following a meeting between BYD chairman Wang Chuanfu and Vietnam’s deputy prime minister Tran Hong Ha. Reports say the company had also been considering the Philippines and Indonesia, as well as Vietnam. The plant will serve the domestic market and export to other markets in the region.

Source from Just-auto.com

Disclaimer: The information set forth above is provided by Just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.