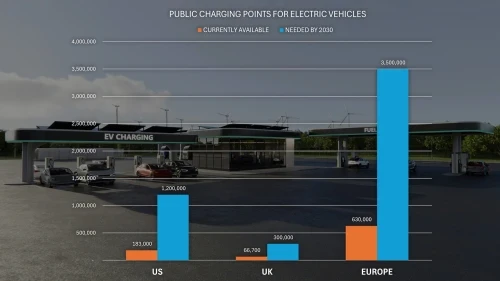

Key markets in the electric vehicle (EV) transition are falling behind in their stated goals for public charging infrastructure, according to latest figures on World EV Day. The data reveals that the US, Europe and the UK are more than six times behind the number of plugs needed to meet growing EV demand by 2030.

The US currently has just 15% of public charging points needed; the UK 22%; and mainland Europe 18%.

The US, the world’s second-largest EV market, has less than 200,000 publicly available charging ports, with more than one million more needed by 2030, according to McKinsey, representing a 550% increase.

Europe needs a 5.5-fold increase to the 630,000 public charge points currently available across the continent to meet European Commission 2030 targets. The UK requires a near 350% increase to scale its charge points from just under 70,000 to 300,000 by the end of the decade.

Yet at current installation rates, these key EV markets will fail to adequately facilitate the EV transition. Europe, for example, is currently three times behind the annual installation rate needed to meet 2030 targets. This deficit in EV charging points represents a considerable opportunity for fuel retailers.

Konect, an innovator in electric vehicle charging established by global retail and commercial fueling leader Gilbarco Veeder-Root (GVR), believes that existing fuel retailers are in a prime position to plug the gap, due to their optimum blend of location and amenities.

At current installation rates, key global EV markets won’t meet the public charging infrastructure needed to meet growing EV demand. We know that most EV drivers currently plug in at home, but there’s a second cohort of buyers, beyond the early adopters, that don’t have the same facilities.

As EV technology improves, costs go down and range goes up, more people will make the switch. We must match this progress with the right amount of readily available public charging. We need some logical thinking on the placement of new charge points—ideally, locations that are already familiar and convenient for car drivers. That’s the golden opportunity for the existing fuel retail network.

—Om Shankar, Vice President & General Manager, Konect

However, the industry needs to remove key blockers to effective service in order for fuel retailers to build a business case for reliable and profitable EV charging. In a survey of multiple charge point operators, Konect discovered that more than 71% find recording charge-point downtime at their sites challenging, with 57% identifying support from service partners as the biggest blocker to improved uptime.

Konect provides wrap-around support, including consultancy, installation, maintenance and customer service, offering a flexible, streamlined solution that enables customers to future-proof their facilities. The business supports and manages every step of the EV charging journey, including site selection and funding options, providing market-leading hardware and software solutions, and integration with on-site energy storage.

Source from Green Car Congress

Disclaimer: The information set forth above is provided by greencarcongress.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.