Japanese OEMs are following the Chinese and stepping up plans for manufacturing BEVs in Thailand

Four Japanese automakers have pledged to invest a combined THB150bn (US$4.3bn) to produce battery electric vehicle (BEVs) in Thailand over the next five years, as they respond to the advancement of the Chinese automotive industry into southeast Asia.

Thailand’s Prime Minister Srettha Thavisin made the announcement after holding meetings with leading executives of Toyota Motor Corporation, Honda Motor Company, Mitsubishi Motors Corporation and Isuzu Motors Ltd during his visit to Japan last month.

Thailand wants to play a leading part in the global transition to zero emission vehicles, with the government targeting 30% of the two million or so vehicles produced annually in the country to be mainly battery-powered. Sales of BEVs are estimated to have grown fivefold to 75,000 units last year to account for almost 10% of the country’s domestic vehicle market, making Thailand by far the largest BEV market in South-east Asia – more than twice the size of the region’s largest automotive market which is Indonesia.

BEV sales growth has been driven mainly by the recent entry of Chinese automakers such as BYD, Changan Auto, Geely, Great Wall Motors, SAIC Motor and Chery Auto, which together accounted for over 80% of segment sales last year. BYD claimed the largest share, with its Atto 3 model alone accounting for almost one-third of segment sales. The Japanese are suddenly left playing catchup in a market they have dominated for many decades.

Following last year’s strong sales growth, Thailand – under its new EV3.5 programme – reduced BEV purchase subsidies at the beginning of January to between THB50,000 and THB100,000 (US$1440-US$2,880) for vehicles priced below THB2m (US$58,000) and with a battery size of at least 50 KWh, while smaller BEVs will qualify for subsidies ranging between THB20,000 and THB50,000 (US$580-US$1,440). BEVs in Thailand typically cost between THB1.2m and THB1.7m (US$34,600-US$49,000).

The government also reduced import duties on completely built-up electric vehicles costing up to THB2m by up to 40% for two years to help automakers grow their initial sales, while excise taxes were reduced to 2% from 8%. Other incentives are available to help localise production, including import duty cuts on knocked down (CKD) vehicles, components and manufacturing equipment.

Until recently the main companies to have committed to BEV production in Thailand were the Chinese, along with Mercedes-Benz and BMW, with most looking to build production hubs servicing the region and other right-hand drive markets worldwide. Tesla has yet to respond to the Thai government’s approaches.

Japanese vehicle manufacturers have only recently committed to making significant BEV segment investments, as they look to protect their dominance of the region’s vehicle markets. It looks like Thailand will once again take the lion’s share of regional investment, in the early stages at least. Little in the way of detail has emerged so far, but Toyota and Honda are each understood to be planning to invest THB50bn in Thailand in next five years to establish region BEV production hubs.

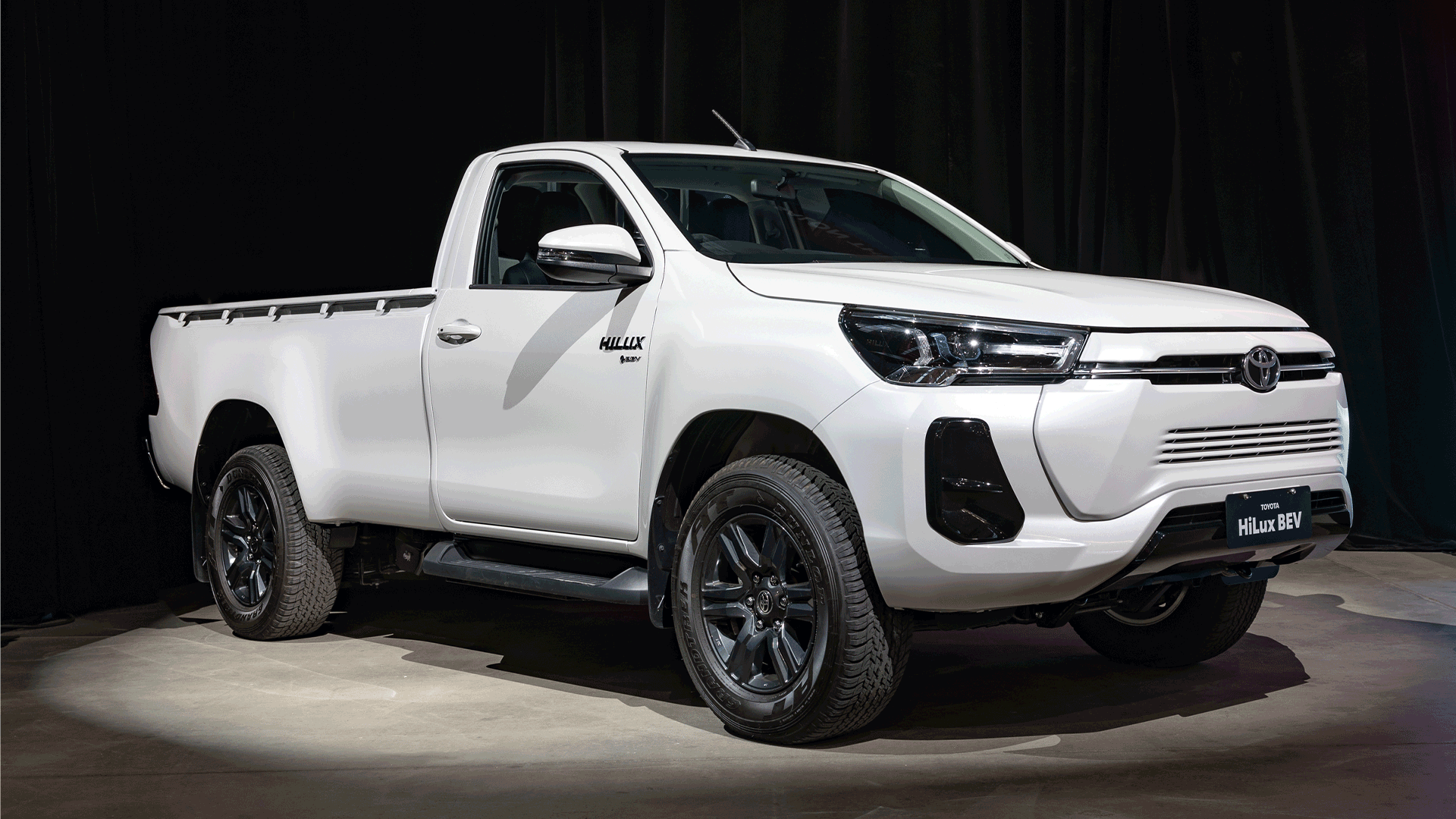

Toyota has begun trials of battery-powered pickup trucks in Thailand, although it has not indicated when mass production will start. The company may also localise its bZ4X electric SUV which is already on sale in Thailand, but its main focus will likely be the introduction of a new range of BEV models based on a new dedicated platform. Toyota said it is also expanding its research and development (R&D) operations in Thailand to include BEV capabilities.

Honda began producing its battery-powered e:N1 in Thailand at the end of last year, the first Japanese BEV to be produced in the country. The compact SUV, based on a purpose-built platform, will go on sale in the first half of this year and is the first in a series of BEV models expected to go into production in the country in the next few years. It looks like Honda has chosen Thailand as it main production hub for southeast Asia, at least initially, as part of its aim of selling over two million BEVs annually in global markets by 2030.

Isuzu confirmed in late 2023 that it plans to begin production of an electric pickup truck in Thailand in the next year, with a planned global market roll-out to begin in Europe in 2025. The battery-powered truck is expected to be based on the D-Max, with SUV derivatives also expected to be produced later on. Isuzu also produces battery-powered versions of the N-series light truck in Japan and these are also being rolled out in the region – competing with the Mitsubishi-Fuso eCanter.

Mitsubishi Motors has already confirmed it will make Thailand its main regional production hub for plug-in hybrid vehicles. The company also said it is testing its battery-powered Mini Cab MiEV model for the local Thai market, but said it will wait to see if demand is strong enough to justify an electric pickup truck.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.