In its latest monthly column for pv magazine, the European Technology and Innovation Platform for Photovoltaics (ETIP PV) presents the main findings of its White Paper on PV manufacturing. The report evaluates how policy and regulatory frameworks have evolved for European companies in the PV sector, and compares these frameworks to the PV industrial-policy evolution of key global markets such as China, India, and the USA.

ETIP PV has just published an update of its White Paper on PV manufacturing originally published in May 2023. The newly updated paper focuses on three core points.

First, it evaluates how policy and regulatory frameworks have evolved for European companies in the PV sector, and compares these frameworks to the PV industrial-policy evolution of key global markets (for instance, China, India, and the USA).

Second, it discusses the resilience of the European PV value chain, and notably the long-term economic impact of the above-mentioned measures on the energy price in Europe.

Finally, it explores the role of innovation in the growing number of industrial policies in Europe, to better understand how to capitalize on Europe’s broad landscape of research institutes and innovative companies.

- Industrial policies introduced or proposed in the second half of 2023

The European Union and European Member States are building the premises of an industrial strategy for photovoltaics and over the second half of 2023, they have announced in more detail the policies that are to support the re-industrialization of the PV value chain. Some of these policies include, but are not limited to the Net Zero Industry Act, the Temporary Crisis and Transition Framework, and the Critical Raw Materials Act. Other than these EU-based frameworks, each member state presents its own policy strategies, discussed in more detail in the ETIP PV’s publication.

Beyond the PV industrial policies in the EU, the paper also briefly discusses PV manufacturing policies in India, the USA, and China. India has created a specific framework for domestic manufacturers that mix provisions ranging from barriers to competitors on specific market segments, tariffs, CAPEX and OPEX support. USA has boosted its solar cell and module production capacity via the Inflation Reduction Act (IRA) and significantly decreasing taxes and banning imports of non-ethically manufactured PV products. However, the IRA has so far not been successful across the whole value chain; for instance, no new investments into solar polysilicon have been publicly announced. Finally, China – as the leading global PV manufacturer – has had major policy incentives and manufacturing investments since 2001. More recently, China has announced two other key programs: the Golden Sun program – to subsidize demand linked to the installation of highly efficient technologies, and the Top Runner program – to incentivize manufacturers to target the most efficient PV technologies.

- The cost of resilience policies for European consumers

The Cost of Ownership (CoO) assuming a 10 GW integrated PV manufacturing factory was analyzed for three PV technologies: TOPCon, HJT, or IBC (all of which are rapidly gaining market share because they promise higher efficiency than PERC) for China (low and high scenario), India, EU (low and high scenario), and the USA. China (low) has a 16 (TOPCon and IBC) and 17 (HJT) USDct/Wp, China (high) and India have a 19 – 21 USDct/Wp for all technologies, EU (low) has a 24 – 25 USDct/Wp, EU (high) has around 30 USDct/Wp, and the USA has around 28 – 29 USDct/Wp for all technologies. The cost variations are present due to different material, labor, equipment, and building costs – all of which are higher in the EU and the USA than in China and India.

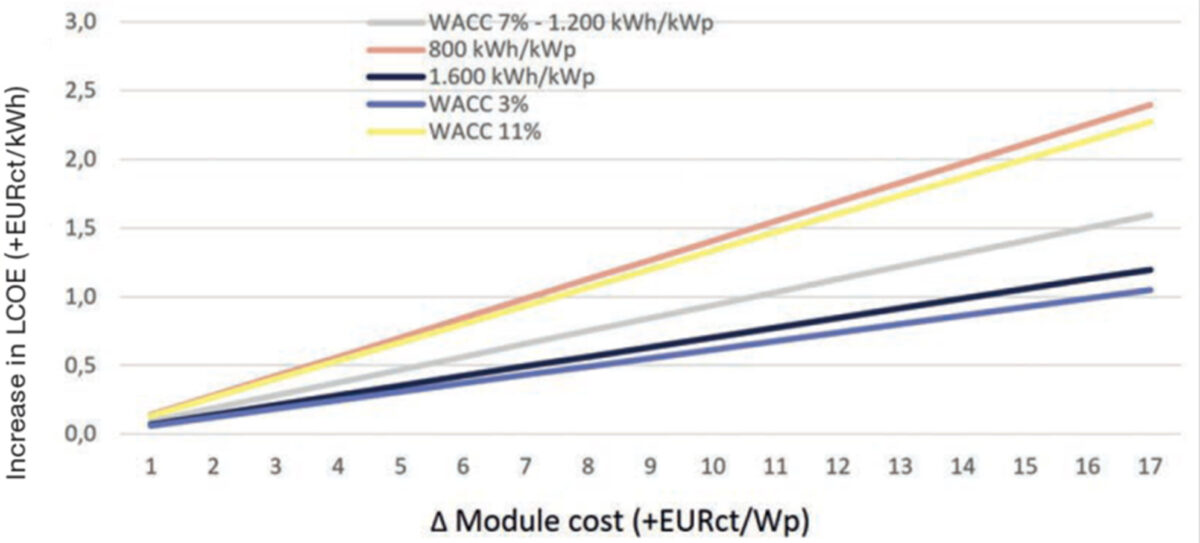

Next, the paper explored the influence of higher module prices on the LCOE at different locations and with different capital costs. As the European economy is exiting a sustained period of low-interest rates, the impact of interest rates will be felt much more by project developers and poses an additional challenge to the imperatives of resilience. In a context of very high-interest rates (e.g. 11%), a utility scale product in a Northern European climate could be faced with projects whose LCOE is up to 25% higher for ‘resilience’ in the case of modules that are 15 cEUR/Wp more expensive to produce. This could have a significant impact on development rates. However, if the production cost difference is minimized (e.g. 5 cEUR/Wp) and interest rates remain moderate (e.g. 3%), resilience only carries a premium of around 5%.

To solve the resilience challenges, policymakers need to ensure they provide tools to minimize the production cost spread for PV manufacturers. While an important current focus of support policies in Europe lies on CAPEX, it appears clear from the cost structure of PV manufacturing (where electricity is a particularly impactful component for relative competitiveness) and the comparative success of countries opting for another approach (e.g. the US) that dedicated OPEX tools would also be relevant to consolidate the European PV industrial supply chain.

Therefore, to support the transition of European PV manufacturing toward global competitiveness (i.e. narrowing the gap on the cost/Wp differential), various measures can be relevant as it is crucial to address different gaps in the value chain.

- Technology focus: trends and the impact of industrial policies on R&I efforts, considering the role of manufacturing equipment

To compete globally on introducing innovative technologies to the market, EU industrial actors focus on investing in R&I, while EU manufacturers adopt the relevant strategy of rapid manufacturing growth, which includes accessing imports of significant volumes of affordable equipment from Asia. The industry faces the challenge of the sheer scale of equipment, investments, production and delivery needed in such a short period. One of the key challenges that policymakers must address at the European and national levels is finding a balance between the need for rapid scale-up of manufacturing capacity and reaching sufficient cost-competitiveness for the short-term resilience of the European PV industry, and the need to sustain competitiveness through innovation and high-quality products to reach the market at scale for the long-term resilience of PV European market.

With the lack of multi-GW scale integrated PV manufacturing in Europe and the increasing competition with Asian machine manufacturers, European equipment manufacturers are left with difficult research and development (R&D) investment choices. In worst-case scenarios, these machine manufacturers risk the development of tools that do not penetrate the market and will not generate turnover, despite the high R&D investments. Thus, a de-risking factor and the commitment of companies to invest in the further development of their products and services are necessary to enhance the position of European machine manufacturers and in turn the entire PV manufacturing industry.

Moreover, a supportive European R&I strategy opens new possibilities leading to the diversification of cutting-edge technologies. Topics of specific importance for machinery and equipment R&I, to name a few, include data-driven machine learning approaches, the carbon footprint of the equipment, lower consumables use, and high-quality results on the product level.

Finally, upscaling manufacturing is an important step in the short term, but providing the tools to bring new technologies to the market is also imperative since performance and technological leadership are a major component of competitiveness.

Therefore, a crucial challenge of the current industrial policy is to ensure the European PV sector will be able to ride the upcoming wave of innovative technologies, most notably with the emergence of new processes for emerging materials such as perovskites.

If you want to stay tuned for more information on the ETIP PV’s events and activities, then follow us via our monthly newsletter, our monthly articles at pv magazine, or our LinkedIn channel. Furthermore, if you are interested in working with us, then consider applying to join one of our working groups – we are always actively looking for experts and PV enthusiasts to join our working groups.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Source from pv magazine

Disclaimer: The information set forth above is provided by pv-magazine.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.

Afrikaans

Afrikaans አማርኛ

አማርኛ العربية

العربية বাংলা

বাংলা Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch हिन्दी

हिन्दी Bahasa Indonesia

Bahasa Indonesia Italiano

Italiano 日本語

日本語 한국어

한국어 Bahasa Melayu

Bahasa Melayu മലയാളം

മലയാളം پښتو

پښتو فارسی

فارسی Polski

Polski Português

Português Русский

Русский Español

Español Kiswahili

Kiswahili ไทย

ไทย Türkçe

Türkçe اردو

اردو Tiếng Việt

Tiếng Việt isiXhosa

isiXhosa Zulu

Zulu