What’s a good way to keep shoppers glued to your app? For Temu users, it appears to be ‘spin-to-win,’ a feature that offers new users a chance to win US $100-200 in instant shopping coupons.

Effective promotions such as these coupled with clever social media marketing strategies helped Temu to become the most downloaded shopping app in 2023.

Temu’s success even reportedly influenced TikTok, 2022’s most downloaded social media app, to launch its ecommerce marketplace in August 2023. It’s only natural then that Amazon, the world’s largest ecommerce platform in terms of market capitalization and revenue, began to feel threatened by Temu’s rise.

In this blog, we’ll outline the main differences between Temu and Amazon in terms of their business background and focus, marketing strategies, target audience, order fulfillment, and returns, as well as overall policies and seller environment.

Table of Contents

Temu vs. Amazon: Background and ownership

Business focus

Target audience and marketing strategies

Order fulfillment and returns

Seller environment and policies

An ongoing battle between rising star and reigning titan

Temu vs. Amazon: Background and ownership

It is impossible to discuss the history and ownership of Amazon without mentioning Jeff Bezos. Currently the third-richest person in the world, and the richest man in the world for four consecutive years from 2017 to 2021, Bezos established Amazon out of his garage near Seattle, launching it as a humble online bookstore with his then-wife in 1994. From that point on, he proceeded to transform Amazon into the world’s largest ecommerce giant.

Despite Temu espousing its “US roots,” stating on its website that it was founded in Boston, Massachusetts in 2022, it’s a well-known fact that Temu’s background is indeed deeply intertwined with Chinese ownership, specifically through its parent company, PDD Holdings. PDD also owns Pinduoduo, the third-largest ecommerce platform in China, the world’s largest ecommerce market, and boasted estimated revenues of US $20.92 billion in the most recent 12-month period.

Business focus

The brands’ respective slogans are probably the best way to sum up how they approach business, succinctly accentuating the fundamental differences between the two brands. Temu, for example, takes a price-leading approach, while Amazon believes in putting the customer first.

Temu’s “Team Up, Price Down” slogan also mirrors its sister company Pinduoduo’s wholesale approach, helping buyers to obtain better target prices. On the contrary, Amazon understands that price isn’t everything, which also strives to make sure that the overall needs and expectations of customers are met, on top competitive rates.

For example, Amazon prioritizes fast and on-time delivery, as well as product quality. Couple these with a broad range of globally sourced products, and you have a massive commercial force. In contrast, the majority, if not nearly all of Temu’s products originate from China. Furthermore, these goods are often unbranded, generic, and no-frills, allowing them to be offered at extremely low prices but drawing ire for being wasteful and even potentially hazardous.

Target audience and marketing strategies

Amazon and Temu each cater to distinct target customers. Amazon serves global retail consumers and businesses through Amazon.com and its B2B-centric Amazon Business site. Conversely, Temu targets retail consumers, especially online shoppers in the United States, via its app. It has also pushed to expand to Europe, Australia, and New Zealand.

Temu’s marketing strategy also centers on social media, encouraging users to become “ambassadors” by sharing referral codes, in addition to its affiliate and influencer programs. In various regions, participants can earn free “Star Coins” or up to 20% commissions. These affiliates and referrals attract others to make purchases via extremely low-priced items, shopping experiences enriched by gamification, and a free 90-day return policy.

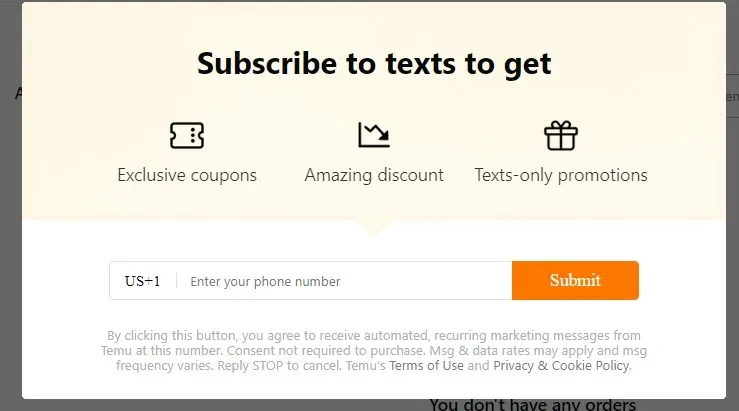

While many companies still rely heavily on email marketing, which is susceptible to junk filters and easy filtering, Temu uses SMS text marketing, complementing its targeted and personalized email campaigns, to better reach customers.

In contrast, Amazon, which is approaching its 30th anniversary, has implemented various marketing strategies during its development, including SEO and affiliate programs that focus on customer retention and loyalty. In recent years, Amazon has particularly emphasized its Amazon Prime program, a subscription service that offers fast delivery and exclusive access to events like its Prime Day, known for limited-time offers and discounts.

Order fulfillment and returns

Temu offers free delivery within 6-25 days, with an express option ranging from 2-3 days. Its free shipping applies to nearly all products, and customers benefit from a comprehensive list of carrier contacts in the case of any delivery issues. Additionally, Temu provides a 90-day return window under its Temu Purchase Protection Program, with options for refunds via original payment or as Temu credit.

In contrast, Amazon has various delivery choices, including same-day for Prime subscribers, but with varying costs. Its returns are limited to 30 days, depending on the item and Amazon seller policies. Amazon’s refund methods include via credit card, debit card, and Amazon Gift Cards, with the varying processing times up to 30 days.

Seller environment and policies

Ecommerce platforms like Amazon and Temu have played a crucial role in defining the online seller experience. Amazon operates as a one-stop-shop platform, selling its own brand products and those of third-party sellers while enforcing strict policies against counterfeit goods to maintain market quality. Its terms and conditions balance its offerings and third-party vendors’ presence.

In contrast, Temu’s stance in the seller ecosystem is somewhat unclear. Its terms and conditions suggest it acts solely as a marketplace, focusing on technical support and distancing itself from post-sale responsibilities. However, separate FAQs on its site show involvement in customer service, returns, and refunds, blurring the lines of its role.

Meanwhile, some sources note that Temu follows a “fully managed” seller management model, particularly aiding Chinese vendors with logistics, fulfillment, and customer support. This approach suggests that Temu sellers mainly focus on sourcing goods and ensuring product quality, with limited control over their selling price, contrasting with the broader responsibilities of sellers on other platforms.

An ongoing battle between rising star and reigning titan

The face-off between Temu and Amazon – two competitors heavily invested in and focused on B2C ecommerce – is destined to continue. Temu, albeit relatively new, has rapidly evolved in its business focus and marketing strategies, keenly targeting a younger, social media-savvy audience. Concurrently, Amazon remains the experienced ecommerce giant with a diverse business model, and positions itself in a way that it appeals to a broad spectrum of customers who value quality products, ultra-fast same-day delivery, and loyalty rewards.

Both Amazon and Temu have intricate fulfillment, returns, and refund policies while offering a rather distinctive seller ecosystem that draws different types of businesses into their orbits. While Amazon benefits from decades of operational expertise and global brand recognition, Temu is agile enough to react to its target market’s demands for low prices. In fact, according to multiple latest reports, it is believed that Amazon has lost a significant number of users to Temu since early 2023, including an estimated 1 million daily users from Amazon UK.

On the flip side, despite its extremely high app downloaded volume, PDD Holdings may incur significant expenditure regarding Temu, with China Merchants Securities predicting that the platform would lose some US $500 million to US $900 million this year. In short, whether you’re a seller seeking to join one of these platforms or a consumer thinking about their next online purchase, the fight between these two ecommerce giants is worth closely monitoring and learning from.

To stay up to date on similar news stories gripping the ecommerce world, as well as sourcing insights, industry updates, and business ideas, visit Alibaba Reads today!