Battery electric car demand was up 10.8% in month as buyers responded to heavy discounting

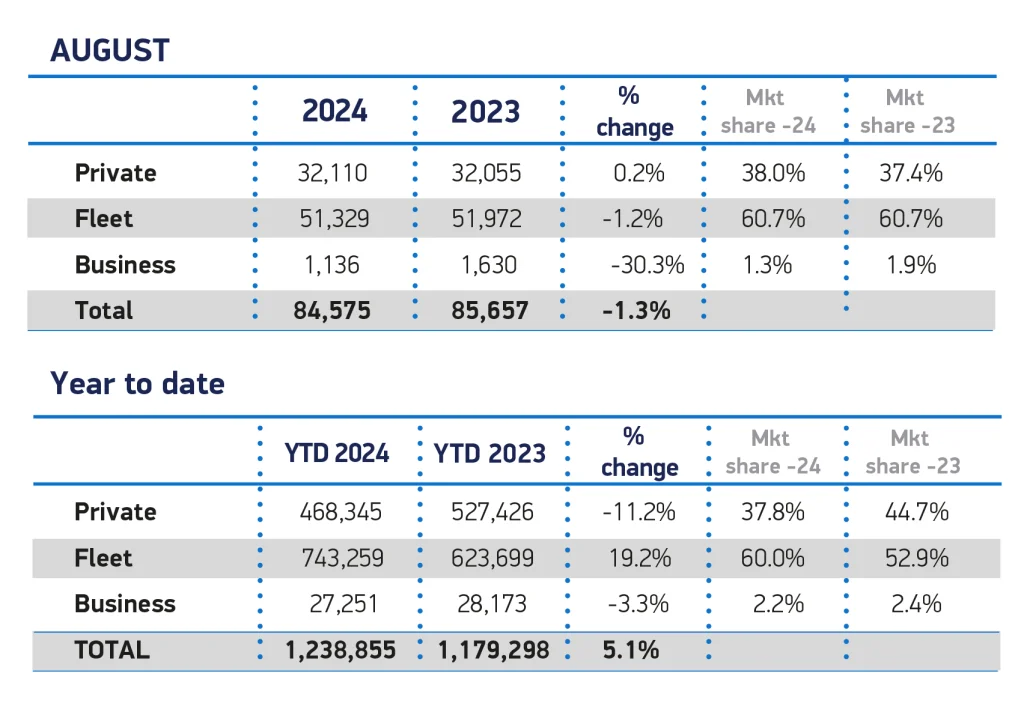

The UK new car market remained stable in August, down just 1.3%, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

In what is traditionally one of the quietest months of the year for new car sales, with many buyers preferring to wait until September’s new (year identifier) number plate, 84,575 units were registered, just 1,082 fewer than in the same month last year.

Continuing the recent trend, fleet purchases again drove the market, accounting for six in 10 cars registered last month, or 51,329 units, despite a 1.2% drop compared with the same month last year. Registrations by private buyers were flat, up 0.2% units to 32,110.

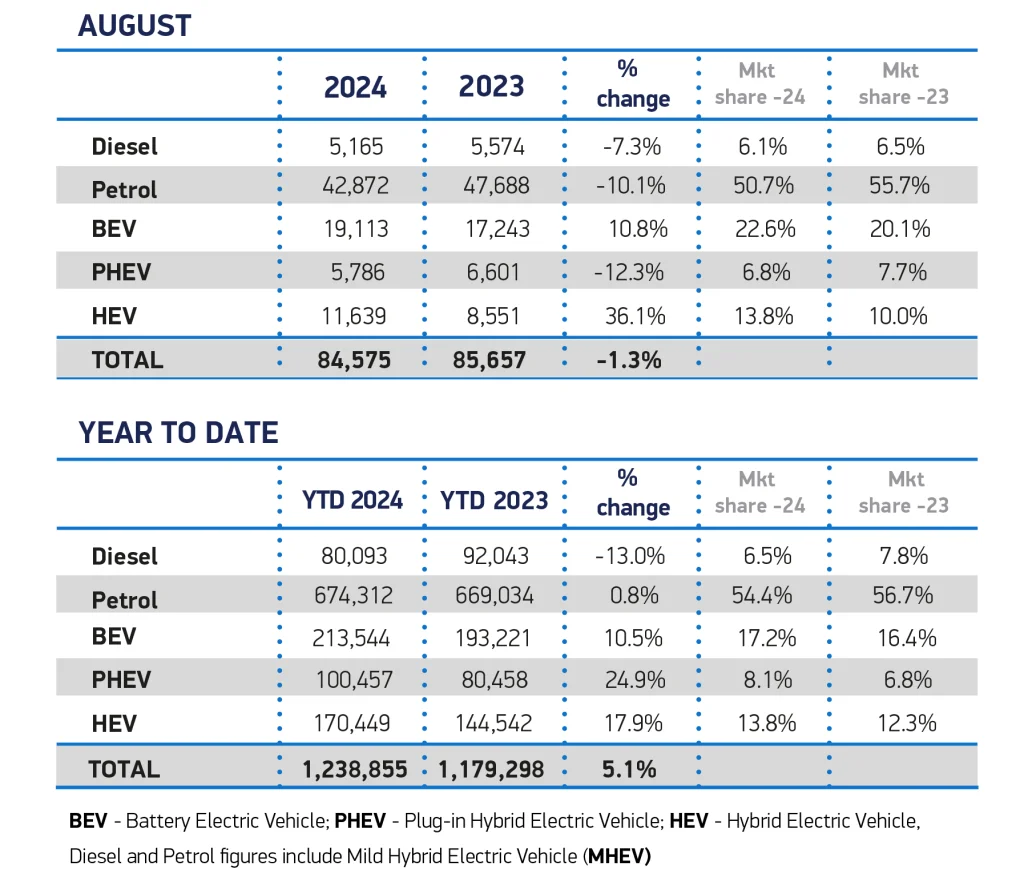

Petrol and diesel sales fell by 10.1% and 7.3% respectively, but together these fuel types still represented more than half (56.8%) of all new car sales in August. Plug-in hybrid (PHEV) registrations declined 12.3%, with a 6.8% share, but hybrid electric vehicle (HEV) uptake increased, by 36.1%, to take 13.8% of the market.

Battery electric vehicle (BEV) registrations, meanwhile, rose 10.8% thanks to heavy discounting by manufacturers over the summer and a raft of new models attracting buyers. Market share in August reached 22.6%, the highest for a month since December 2022, when BEVs commanded 32.9% of all new cars reaching the road.

Year to date, BEV market share has edged up to 17.2% and is expected to rise further to 18.5% by the end of the year thanks to increasing model choice – with some 364,000 BEVs registrations forecast for the year by the SMMT (on a forecast 2m total market, that would amount to around 18% share). So, despite this growth, this will still be shy of the 22% share required by the Zero Emission Vehicle Mandate. If manufacturers fail to meet that share, they could incur hefty fines applied on each vehicle sold under the 22% target zero emission share for the year.

Ahead of the Autumn Budget due on 30 October, the SMMT is calling for ‘urgent action to bolster the market for new EVs, including binding targets on public chargepoint provision commensurate with those placed on industry, the reintroduction of incentives for private buyers and removal of disincentives, including the Vehicle Excise Duty expensive car supplement, set to be introduced in 2025’.

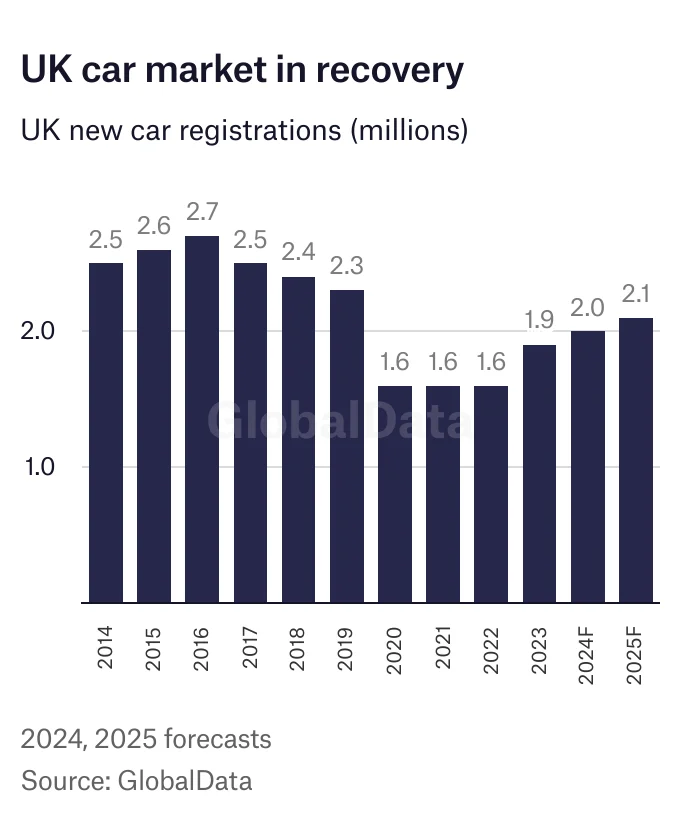

GlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

Mike Hawes, SMMT Chief Executive, highlighted the need for more EV charging infrastructure. He said: “August’s EV growth is welcome, but it’s always a very low volume month and so subject to distortions ahead of September’s number plate change. The introduction of the new 74 plate, together with a raft of compelling offers and discounts from manufacturers, plus growing model choice, will help increase purchase consideration and be a true barometer for market demand. Encouraging a mass market shift to EVs remains a challenge, however, and urgent action must be taken to help buyers overcome affordability issues and concerns about chargepoint provision.”

Richard Peberdy, UK Head of Automotive for KPMG, highlighted the reliance on fleet sales in the UK car market and the likelihood that manufacturers will be short of the UK government’s 22% share zero emission mandate this year. He said: “Private demand is down on last year and new electric vehicle sales are being carried by business buying, in the form of benefit-in-kind and salary sacrifice incentives.

“New EV sales are growing at a pace that presently makes it unlikely that some car makers will be able to meet the target that requires 22% of their 2024 new car registrations to be zero emission. This is leading them to consider how they respond, pondering the likes of discounting, restricting petrol vehicle sales to try and meet the mandated EV percentage of their total sales, and other technical measures regarding carrying the mandate target into the following year.

“With the Budget coming into focus, calls from the industry are likely to ramp up again regarding how new private EV sales can be incentivised. New models emerging at lower prices and discounting are attracting some buyers from new, but others remain concerned about the rate of price depreciation and continue to choose the used EV market to transition. Charging also remains a currently immoveable barrier for some, particularly those with no off-street parking at home. All these factors continue to hold back the pace of EV transition, at a time when the zero emissions sales targets will climb year on year for car makers.”

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products. Alibaba.com expressly disclaims any liability for breaches pertaining to the copyright of content.