The Volkswagen Group says it has made decisive progress in its four industry-leading technology platforms. It also says it is tapping into additional profit pools as part of its transformation from legacy automaker to integrated mobility provider by further expanding its sustainable mobility business.

At the VW Group’s press conference at IAA Mobility in Munich last month, CEO Oliver Blume said: “We are making good progress. And faster than planned. We have reached numerous milestones, set important strategic directions and achieved joint successes. We are systematically driving forward the transformation along our ten-point plan and consistently developing further attractive profit pools in the area of sustainable mobility.”

As a strategic framework, the ten-point plan defines the most important fields of action for the VW Group’s transformation. The company’s four technology platforms play an integral role: architecture, battery & charging, software and mobility.

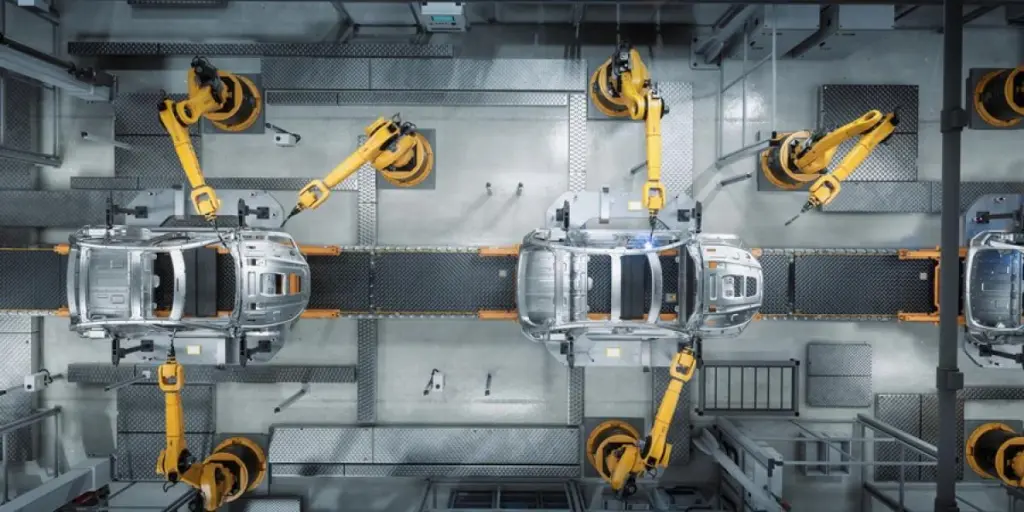

Architectures/platforms

Since 2012, around 45 million vehicles have been produced on the successful Modular Transverse Toolkit (MQB). With the Modular Electric Drive Matrix (MEB), the company was one of the first to transition its platform strategy into the electric age. Since 2020, more than 1.1 million fully electric vehicles have been delivered by five VW Group brands on the MEB platform.

The VW Group will introduce the latest generation of e-mobility platforms with the new Premium Platform Electric (PPE) from 2024; this will be followed in 2025 by the improved Modular Electric Drive Matrix MEB+ with longer range, shorter charging times and new models with planned entry-level prices below 25,000 Euro.

From 2025, it is planned that the enhanced MEB+ platform will bring a further increase in range and efficiency of around 10 per cent. VW also claims it offers acceleration times of less than 5 seconds from 0 to 100 km/h and fast charging of less than 20 minutes based on the unified cells with Cell2Pack technology.

One year earlier, in 2024, the VW Group’s second electric platform will be launched: the Premium Platform Electric (PPE) – jointly developed by Audi and Porsche. The platform features an electric drivetrain with a range of over 600 km, as well as 800-volt technology. The Audi Q6 e-tron will be the brand’s first vehicle on the PPE and marks the next major step in the electrification of the model range, VW says.

In the medium-term, the Volkswagen Group will switch to the Scalable Systems Platform (SSP) as a single future backbone with integrated electric and electronics architecture. This, it is claimed, creates ‘enormous standardisation and scaling potential, as more than 40 million vehicles across all brands and segments are to be built on the SSP’. At the same time, VW maintains the intelligent platform concept provides the flexibility to tailor vehicles to the needs of each segment while ensuring the necessary differentiation between brands.

Moreover, VW claims that investment and R&D costs are expected to be reduced by around 30 per cent on SSP compared to MEB, enabling more all-electric models to achieve the same margin compared to their conventionally powered counterparts.

Licensing MEB tech – Ford and Mahindra – and keeping key components in-house

With Ford already opting for the MEB, the Volkswagen Group is now in well advanced talks with Mahindra as another important co-operation partner. Mahindra wants to use key MEB components such as the e-drive and the unified cells for its models.

Unlike some rivals, the VW Group is integrating the development and production of battery cells into its value chain with subsidiary unit, PowerCo. The aim is to keep a significant part of the value creation of a fully electric vehicle within the company. Key levers for reducing battery costs by up to 50 per cent compared to the first generation MEB are the unified cell developed by PowerCo, the standardised cell factory, and other innovations such as dry coating and low- cost cell chemistry without cobalt and nickel. This, VW says, makes e-mobility affordable for broader segments of the population and even more sustainable.

However, that does not preclude strategic partnerships in critical areas. Battery materials firm Umicore and Volkswagen Group-backed battery company PowerCo have just announced the name and branding of their cooperation. Their Brussels-headquartered joint venture for large-scale industrial production of CAM and pCAM in Europe will bear the name IONWAY. Both parents aim to grow IONWAY’s annual production capacity to 160 GWh p.a. by the end of the decade, corresponding to 2.2 m battery-electric vehicles.

IONWAY is designed to supply PowerCo’s European battery cell factories with key battery materials and cover a large part of PowerCo’s EU demand, while providing Umicore with secured access to an important part of the European demand for EV cathode materials.

PowerCo-CEO Frank Blome pointed out that the move actually strengthens VW’s vertical integration strategy in the area of batteries. He said: “Through IONWAY, PowerCo reaches another milestone of our strategy to vertically integrate the battery supply chain. Together with our trusted partner Umicore, we source our own key cell production materials at reasonable prices. Secure access allows PowerCo to supply cost-competitive battery cells to Volkswagen Group for years to come ‒ enabling its brands to offer attractive, affordable EVs to its customers.”

Software-defined vehicle hub

The VW Group is systematically expanding its software expertise as a key driver for future success. To be successful in this area, the company relies on three core elements: focused development, strategic partnerships, and efficient licensing.

VW says that its CARIAD software development unit will accelerate the entire development process by ‘streamlining the project organisation and reducing complexity’. To this end, the Software Defined Vehicle Hub (SDV) will soon be launched. There, employees from CARIAD, Volkswagen and Audi will jointly develop vehicles in what is termed a ‘completely software-centric way’.

Mobility solutions expanded through stake in Pon subsidiary in the area of bicycle leasing

VW also points to the importance of sustainable mobility and cites the planned investment by Volkswagen Financial Services in Bike Mobility Services (BMS), a subsidiary of Pon from the Netherlands – the world’s largest bicycle manufacturer. BMS includes well-known brands as Business Bike, Lease A Bike and B2Bike. This market is booming, as many companies are expanding mobility services for their employees to include bicycles as an extension of their traditional fleet business. The VW Group aims to significantly expand its bike leasing business worldwide as an additional profit pool, with a focus on Europe and the USA. The goal is to become Europe’s largest manufacturer-owned two-wheeler financier. This, it is claimed, will enable the company to take advantage of the trend toward sustainable micromobility and to gain new customer segments.

Another core element in this area is the new mobility platform being set up together with Europcar. It will cover all mobility needs, from hourly rental offers to leasing for several years. In addition, it will conveniently bundle third-party services such as e-scooters and public transportation in one app, even for shorter usage times of just a few minutes. Following a successful pilot project in Vienna, the platform is now to be rolled out successively in Germany and Europe.

Source from Just-auto.com

Disclaimer: The information set forth above is provided by Just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.