A look at 2023 automotive trends and data points, as seen and selected from GlobalData’s databases

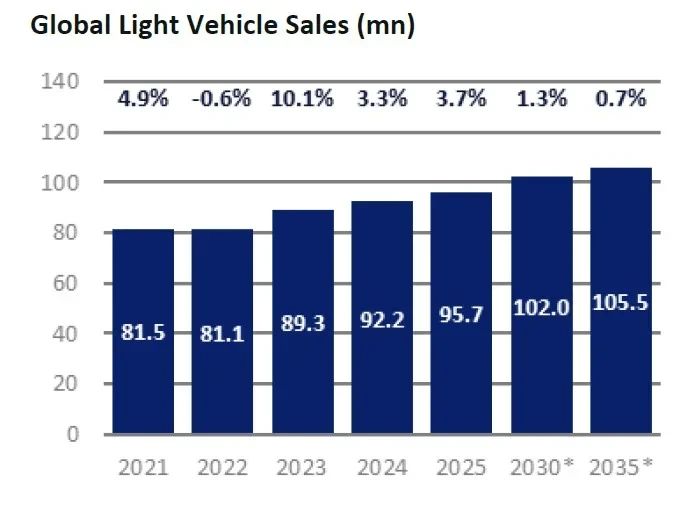

Global light vehicle sales – a 2023 rebound

The global light vehicle market is forecast by GlobalData at a little under 90 million units in 2023. The market bounced back in 2023 (up 10% on 2022) as supply shortages eased and manufacturers were better able to meet customer demand and address order backlogs and start to reduce inventories. For context, that 90 million unit global market level is where we were in pre-pandemic 2019, but the last peak was actually 95 million in 2017.

Through 2023, the market rebounded slightly stronger than expected. The rebound was particularly strong in the US, along with the performance of the US economy. While clouds gathered in terms of the outlook for China, Beijing extended incentives and that kept the automotive market up.

Lately, the outlook for the global light vehicle market has improved once again.

A major reason for the adjustments relate to a change in view in the China market: a stronger outlook in the near-term due to government stimulus to support consumption, with the latest data indicating consumers becoming more willing to spend. However, there is a weaker outlook in the longer-term as sales are likely to be pulled ahead by the temporary purchase tax cut on NEVs, which will be phased out by the end of 2027.

Other recent forecast adjustments include improvements to the near-term for North America and Europe, but with some caution included further out, as well as a reduction in the Middle East forecast due to a collapse in demand in Egypt and weakness in Iran.

The economic outlook remains broadly in line with a quarter ago. From global GDP growth of 2.6% in 2023, it is set to slow to 2.1% in 2024 relating to the monetary policy tightening of the last few years.

BYD was a stellar performer in 2023

As 2023 progressed, it was clear that most manufacturers experienced a volume lift as they became better able to fulfil orders on the back if the easing of the semiconductors shortage. However, it was also apparent that one manufacturer was experiencing particularly rapid growth on year ago levels. One OEM stands out for particularly rapid growth in 2023: BYD Auto.

Attaining a twelve per cent share of its home market during September was quite the achievement (VW: ten per cent and Toyota eight per cent). And yet not too long ago, the company’s decision to end production of IC-only models seemed unnecessarily risky. Instead, it seems to have been a masterstroke as buyers continue to leap on BYD brand hybrids, PHEVs and EVs.

According to the firm’s own data, deliveries for the first nine months exceeded two million units. Growth over the previous year is around 80%. In September alone, the total was 287,494 of which 151,193 were EVs. As for sales of BYD electric vehicles in markets outside China, these numbered a further 28,039 vehicles in September and 145,529 year-to-date.

There are ambitious plans for exports, too. The Chinese OEM also continues to expand into many overseas markets, its cars and SUVs being not only strikingly affordable but also seemingly strong on quality and desirability. The next big test will be how to keep sales rising, along with margins.

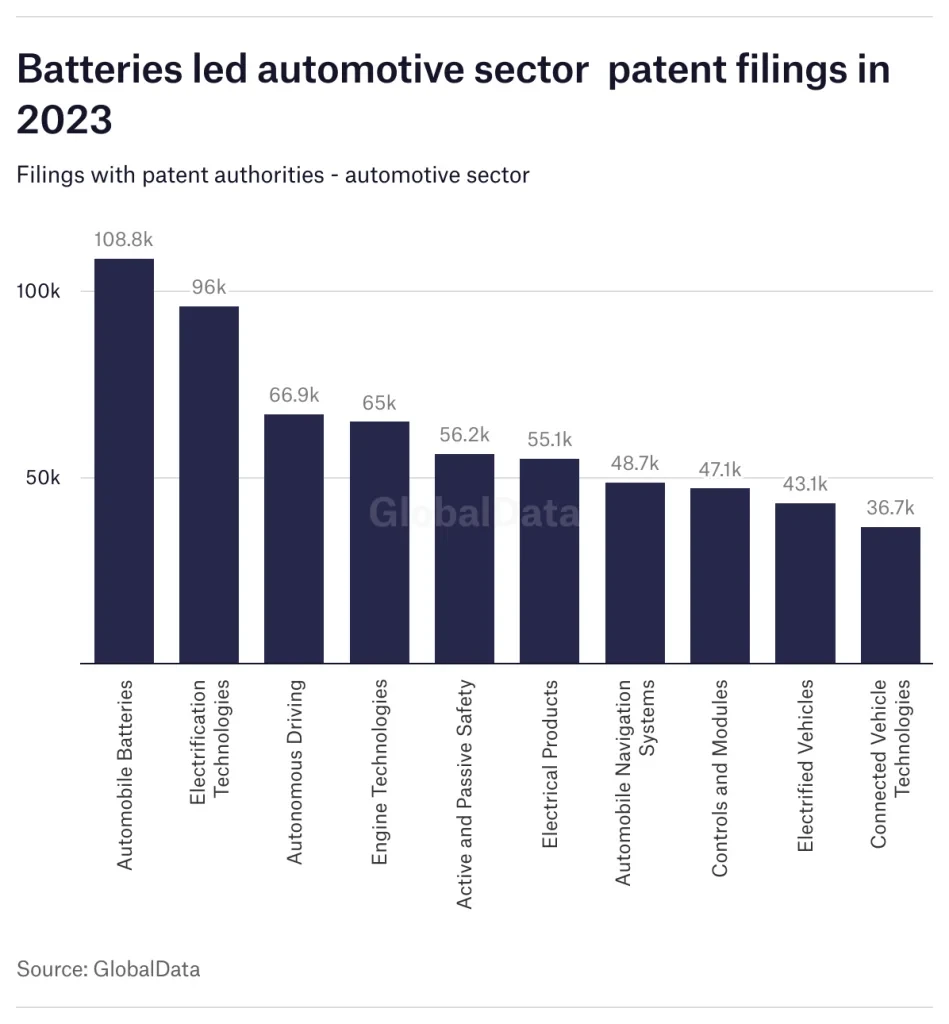

Batteries a focal point for scientific innovation

2023 was a year in which the energy transition and, in particular, electrification – both in terms of vehicle makers and suppliers figured very prominently. Besides the competition for OEMs – with China turning into a key battleground, led by a price war – there were evolving manufacturing and capacity strategies in areas such as batteries. Besides plans for creating new gigafactories, there were also signs of dynamism under the surface in the evolution of battery science, chemistries and technologies.

Over the year as a whole, according to GlobalData’s patents analytics database, batteries patents filed to patents authorities around the world led the list of automotive industry tech sector patents at almost 109,000 filings. Electrification technologies were in second spot.

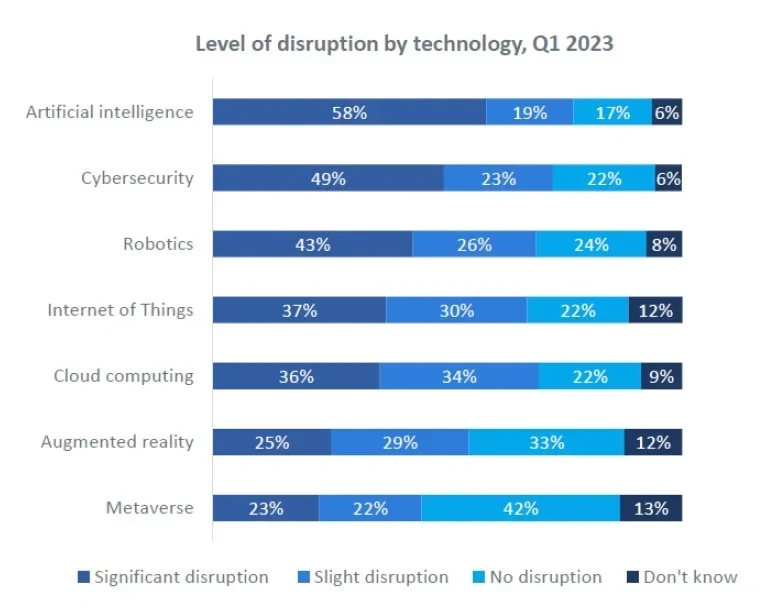

Disruption ahead: AI applications in automotive on the rise

Artificial Intelligence have enabled significant advances in all industries, including more autonomous driving capabilities for vehicles. Of the five advanced AI technologies receiving the most attention today, generative AI is the fastest growing.

Generative AI can support efficiencies across the automotive sector, from inputs into a broad array of business processes , to customer experience, safety and regulation. This impact will only increase as generative AI becomes more accurate and is able to provide reliable factual advice.

Use cases today revolve around vehicle design, safety development and human vehicle interaction.

Generative AI can support efficiencies across the automotive sector, from inputs into a broad array of business processes , to customer experience, safety and regulation.

This impact will only increase as generative AI becomes more accurate and is able to provide reliable factual advice. Use cases today revolve around vehicle design, safety development and human vehicle interaction.

GlobalData surveys of industry show that over three-quarters of respondents expect either slight or significant AI disruption. In Q1 2023, AI held steady as the technology perceived to be the most disruptive. It has maintained the top spot in this poll since Q3 2021.

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.