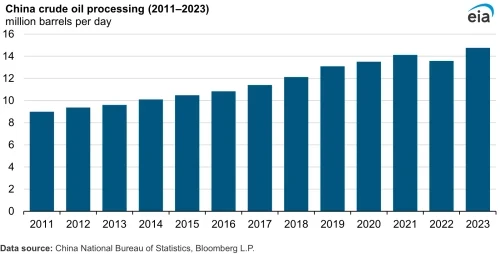

Crude oil processing, or refinery runs, in China averaged 14.8 million barrels per day (b/d) in 2023, an all-time high, according to the US Energy Information Administration (EIA). The record processing came as the economy and refinery capacity grew in China following the country’s COVID-19 pandemic responses in 2022.

China has increased refinery capacity more than any other country in recent years, partially to meet the country’s transportation fuel needs but also to produce feedstocks for its petrochemical industry. In recent years, capacity additions in China have been integrated with petrochemical facilities, increasing production of petrochemical feedstocks such as naphtha and liquefied petroleum gases (LPG), which include propane and butane.

Naphtha is a light hydrocarbon that is further processed to blend into motor gasoline in essentially all US refineries. Much of the petrochemical feedstock for Us petrochemical producers comes from ethane and LPG, which can be separated and sold from natural gas processing plants.

In contrast, many petrochemical producers in Europe and Asia use mostly naphtha (rather than ethane) and LPG as petrochemical feedstocks. Naphtha, LPG, and ethane are used to produce industrial chemicals such as ethylene, propylene, and paraxylene, which are ultimately converted into intermediate or end-use products. Developing integrated refining and petrochemical complexes provides flexibility for these facilities to shift production toward either transportation fuels or petrochemical feedstocks, depending on market conditions.

China’s growing petrochemical sector has made the country one of the world’s largest petrochemical producers. As a result, China’s petrochemical manufacturers need the increased naphtha and LPG produced from China’s refineries, even as China continues to import the two feedstocks, EIA said.

According to trade press, Chinese companies plan to add more capacity, including the 400,000-b/d Yulong refining and petrochemical complex, which was supposed to open in 2024 but is now delayed to 2025.

Source from Green Car Congress

Disclaimer: The information set forth above is provided by greencarcongress.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.