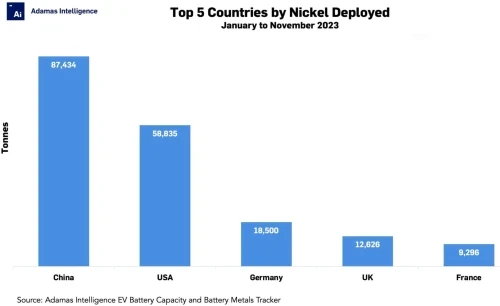

According to data from Adamas Intelligence, through the first 11 months of 2023 a total of 253,648 tonnes of nickel were deployed onto roads in the batteries of all newly sold passenger EVs worldwide—a 40% increase over the same period of 2022.

Through the first 11 months of last year, China led the pack by nickel deployed at 87,434 tonnes, a 27% increase compared to the same period of 2022. China’s share of global passenger EV nickel deployment fell to 34% last year from 38% the year prior, a testament to the growing use of LFP batteries in the country.

The US was ranked second with 58,835 tonnes of nickel hitting roads from January through November 2023, up 50% compared to the same period in 2022. Unlike China, the US increased its share of global passenger EV battery nickel deployment to 23% last year, up from just under 22% during the first 11 months of 2022, Adamas said.

In third, Germany deployed 18,500 tonnes of nickel onto roads through the first 11 months of 2023, up 31% over the same period the year prior, representing 7% of the global total and down from 8% the year before

The United Kingdom came in fourth place with 12,626 tonnes deployed, up 33% year-over-year, followed by France with 9,296 tonnes, up 51% year-over-year – the fastest growing among the top 5 countries.

Although LFP continues to eat into the market share of NCM and NCA batteries, particularly in China, nickel usage in the EV industry is still being propelled higher by a steady rise in the average EV’s battery capacity (i.e., kWh) and an affinity for high nickel cathode chemistries in high-end, performance EV models, Adamas commented.

From January through November of last year, the global sales-weighted average EV’s battery capacity increased by 9% year-over-year to 35.3 kWh, boosted in large part by a 21% jump in the average PHEV’s pack capacity over the same period. At the same time, high-nickel NCM and NCA cells (80%+ nickel) made up 44% of all ternary battery capacity deployed onto roads last year versus a lower 40% the same period the year prior, yet another boon for nickel demand last year, Adamas said.

Source from Green Car Congress

Disclaimer: The information set forth above is provided by greencarcongress.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.