Inflation is expected to ease to 2.9% in 2024, however US consumers are not “reassured” about the outlook of the US economy with 51.5% planning to cut back on retail spend.

As the US economy grapples with the effects of inflation, 46.6% of US consumers believe it will worsen in the first half of 2024, according to GlobalData’s latest report “Apparel Consumer Insights: United States of America.”

Inflation leads to changes in apparel shopping behaviour in 2024

In response to rising inflation, consumers are increasingly vigilant about their purchases. Nearly half of US shoppers (46.7%) are resorting to online price comparisons, leveraging digital platforms to make informed purchasing decisions.

While 42.1% are opting for cheaper brand alternatives, signalling a decline in brand loyalty as cost-consciousness takes precedence.

The US apparel sector in particular is witnessing nuanced spending patterns with 24.5% of shoppers planning to reduce spending on clothing and accessories, as well as 21.2% on footwear.

Females and older demographics exhibit the highest tendency for cutbacks. Plus, the younger generation shows a greater inclination towards discretionary spending, with 31% switching to cheaper stores and outlets such as Shein and Fashion Nova.

US sees rise of second-hand and rental markets on high inflation

A growing trend towards thriftiness is evident in consumers’ engagement with second-hand apparel markets.

Over half (55.7%) of US apparel shoppers donated items to charity or thrift shops compared to all other countries surveyed by GlobalData in December 2023.

A third (34.1%) of consumers shared they had purchased secondhand or pre-loved items and 20% sold items on resale platforms.

The report said the rental market remains “relatively undeveloped” with only 8.9% taking part, however, it noted that this rose to 18.3% among those under 35 as they attend more occasions like weddings with rental services usually focused on occasionwear.

Secondhand apparel in the US is driven primarily by consumers’ desire to “save money” as cited by 81.8% of apparel shoppers. This is off the back of high inflation rates continuing to squeeze consumers’ pockets.

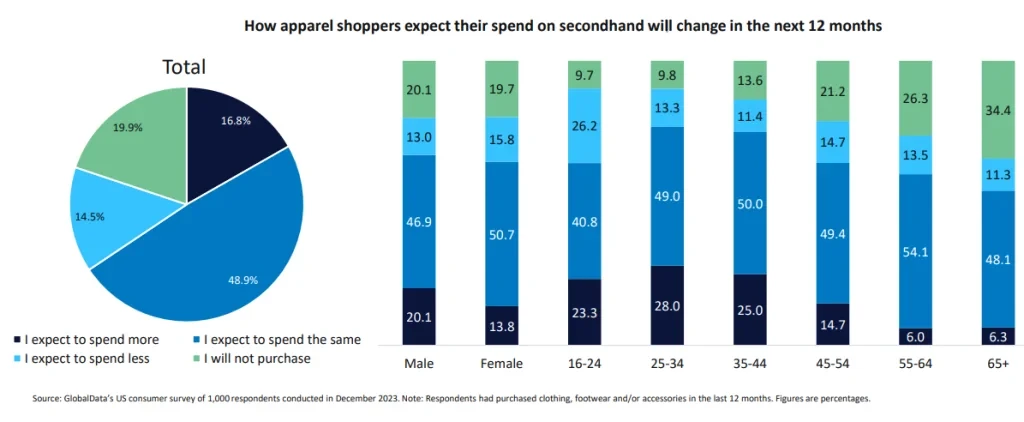

The report notes 14.5% of US shoppers anticipate cutting back on secondhand apparel purchases and 19.9% reported they will not purchase at all.

How will the continuation of inflation affect the US economy?

The April edition of the National Retail Federation (NRF)’s Monthly Economic Review reported a projected growth rate of retail sales between 2.5% and 3.5% and consumer spending was anticipated to increase by around 2%, a slight dip from the 2.3% growth recorded in 2023.

Chief economist Jack Kleinhenz anticipated a gradual decline in inflation rates with a year-over-year projection of 2.2% by year-end.

He explained that the US’s ongoing recovery remains “highly reliant” on consumer spending, expressing confidence that,” barring unforeseen shocks,” economic expansion will persist in 2024, albeit not at a spectacular pace.

In NRF’s March edition, he admitted that inflation and the US Federal Reserve’s efforts to bring it under control will continue to play a major role in the economy this year.

According to the Office of Textiles and Apparel (OTEXA), apparel shipment value from all sources to the US fell 22% to $77.8bn in 2023.

Dr Sheng Lu, associate professor in the Department of Fashion and Apparel Studies at the University of Delaware said at the time: “Considering the predicted slower US economic growth in 2024, the US apparel import volume could stay stagnant for some time.”

Source from Just Style

Disclaimer: The information set forth above is provided by just-style.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.