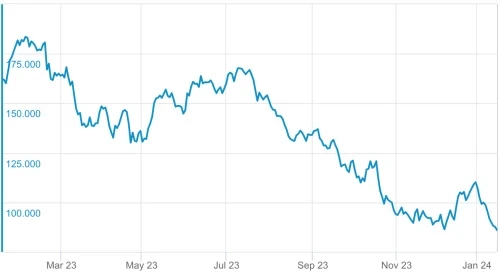

Leading supplier of lithium and lithium derivatives Albemarle is cutting its planned capex in 2024 from approximately $2.1 billion in 2023 to the range of $1.6 billion to $1.8 billion as the company adjusts to changing end-market conditions, particularly in the lithium value chain.

This new level of spending reflects a re-phasing of larger projects in the near term to focus on those that are significantly progressed, near completion and in startup. Decisions made by the company include to:

- Commission the Meishan lithium conversion facility, which reached mechanical completion at the end of 2023;

- Complete commissioning activities for Trains 1 and 2 at the Kemerton lithium conversion facility and focus construction on Train 3;

- Prioritize permitting activities at the Kings Mountain spodumene resource and defer spending at the Richburg mega-flex lithium conversion facility;

- Defer investment for the Albemarle Technology Park in North Carolina; and

- Limit sustaining capital spending to the most critical health, safety, environmental, and site maintenance projects.

The actions we are taking allow us to advance near-term growth and preserve future opportunities as we navigate the dynamics of our key end-markets. The long-term fundamentals for our business are strong and we remain committed to operating in a safe and sustainable manner. As a market leader, Albemarle has access to world-class resources and industry-leading technology, along with a suite of organic projects to capture growth.

—Albemarle CEO, Kent Masters

Albemarle is also planning actions to optimize its cost structure, reducing costs by approximately $95 million annually, primarily related to sales, general, and administrative expenses, including a reduction in headcount and lower spending on contracted services. Albemarle expects to realize more than $50 million of these cost savings in 2024 and to pursue additional cash management actions primarily related to working capital.

Source from Green Car Congress

Disclaimer: The information set forth above is provided by greencarcongress.com independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.