Global wholesalers and retailers choose to source and import their goods from China due to its extensive manufacturing capacity, competitive labor costs, and advanced technological infrastructure. Furthermore, China’s interconnected supply chain networks ensure efficient production and logistical operations, reaffirming its status as the “world’s factory.”

Canadian businesses are no exception in the global trend of sourcing goods from China. In fact, the Canadian market has growing consumer spending, which rose to CAD$1.330 billion in the third quarter of 2023. Additionally, with total imports reaching approximately CAD$635.82 billion, Canada demonstrates a high-demand environment suitable for foreign goods, including Chinese products.

However, importing goods from China into Canada involves numerous logistical hurdles, endless paperwork to complete, and various taxation and legal requirements to consider. No worries, though, as this blog will simplify the entire import process into five easy steps. Continue reading to learn the ins and outs of bringing goods from China to Canada effortlessly!

Table of Contents

1. Obtain the necessary licenses and permits

2. Prepare the necessary shipping documentation

3. Calculate import duties and taxes

4. Arrange for the shipping

5. Report and release the goods

6. Simply the process of importing to Canada with Customs brokers

1. Obtain the necessary licenses and permits

When importing commercial goods into Canada, businesses should first obtain a Business Number (BN) before deciding which product to import. This 9-digit unique identifier, provided by the Canada Revenue Agency (CRA), is mandatory for interactions with the Canada Border Services Agency (CBSA) and for clearing goods at the border. Businesses can register online for BN via the Business Registration Online (BRO) service.

After securing a BN, businesses should then verify whether the goods they wish to import are prohibited or subject to restrictions. This involves cross-referencing the intended products against the “Prohibited Importations” outlined in the Memoranda Series D9. For example, the importation of white phosphorous matches into Canada is prohibited, as they pose significant health and environmental hazards.

After confirming that the intended products for importation are neither prohibited nor restricted, businesses can typically proceed with their importation without obtaining an import license or permit. However, goods listed in the Import Control List (ICL) require an import permit issued by Global Affairs Canada. Specific items mentioned on the ICL include military goods and firearms, items regulated by the Chemical Weapons Convention, strategic goods and technology, and others.

Moreover, some consumer products require additional certifications or licenses to ensure compliance with Canadian safety, health, environmental protection, and security standards. For example, importers of food items must adhere to regulations set forth by the Canadian Food Inspection Agency (CFIA). This compliance involves acquiring an import permit, providing proof of inspection from the product’s country of origin, or meeting specific labeling and packaging requirements.

2. Prepare the necessary shipping documentation

After ensuring their business is properly registered, and their products comply with Canadian regulations, importers must prepare the necessary shipping documents. Except for low-value shipments (LVS) valued at CAD$3,300 or less, which are eligible for simplified paperwork, the absence of correct and detailed shipping documentation can result in commercial goods imported into Canada being delayed, confiscated, or incurring penalties.

The table below presents a non-exhaustive overview of the required shipping documentation when importing goods from China into Canada:

| Document Title | Purpose | When Needed |

| Import permits/licenses | The CBSA typically requires these documents, obtained during Step 1 of the import process, for goods subject to import restrictions or quotas, such as agricultural products, firearms, animals and plants, and certain textiles. | Before importation |

| Bill of Lading (BOL) or Airway Bill | This document serves as a contract between the consignee (the importer or owner of the goods) and the carrier (the company transporting the goods). As obtained in Step 4 below, this document lists the type and quantity of the goods, their origin and destination, and the Incoterms for transporting them. | Upon shipment Upon arrival |

| Manifest or Cargo Control Document (CCD) | The CCD, issued by the carrier during the arrangement of the shipping method in Step 4 below, serves as a manifest for all goods being transported into Canada. Each CCD is associated with a unique barcoded Cargo Control Number (CCN), incorporating the carrier’s 4-digit code and thus providing a traceable identifier for the shipment. | Upon shipment Upon arrival |

| Commercial invoice or Canada Customs Invoice (CCI) | The CBSA primarily uses the commercial invoice, or the Canada Customs invoice, when the commercial invoice is not available or lacks all the required information to calculate duties and taxes on imported goods in Step 3 below. | Upon arrival At clearance |

| Certificate of Origin | This document certifies the country in which the goods were manufactured, including information about the product’s origin. It may be necessary to qualify for preferential tariff treatment under free trade agreements (FTAs). Although there are no FTAs between Canada and China, Customs authorities still require this document to determine the applicable duty rates in Step 3 below. | Upon arrival At clearance |

| Packing list | This document provides key information about a shipment, including its contents, weights and measures, box or crate numbers, and other pertinent details to facilitate clearance and delivery. It also acts as a checklist for both the exporter and the importer to verify the shipment contents against the documentation provided. | Upon arrival At clearance |

| Canada Customs Coding Form | The CBSA uses this document, also known as Form B3, for customs clearance and the determination of applicable duties and taxes. It includes comprehensive details such as the importer’s name and address, detailed descriptions of the goods, their quantity, value, and the currency used. Additionally, this form includes the tariff classification number. | At clearance |

3. Calculate import duties and taxes

After preparing shipping documents, it’s time to estimate the customs duties and taxes applicable to the imported commercial goods. Although the calculation process can be somewhat complex, let us walk through a hypothetical example to understand how things work.

Consider a food company headquartered in Quebec, Canada. This company specializes in producing baked goods and wants to import powdered buttermilk into Canada.

Step 1: Classify the product

The food company’s initial step involves identifying the tariff classification number of powdered buttermilk using both the Harmonized Commodity Description and Coding System (HS) and the Canadian Customs Tariff.

This unique identifier comprises 10 digits, with the first 6 digits being universal to all countries that adopt the Harmonized System and the last 4 digits reflecting Canada’s specific classification rules. Click here to learn how to read Canadian tariff classification numbers.

Businesses can consult the Canadian Importers Database (CID) to determine the 10-digit classification number. Importers of food items can also use the Automated Import Reference System (AIRS), an online tool that provides import requirements for commodities regulated by the Canadian Food Inspection Agency (CFIA).

In our example, the food company determined the 10-digit Harmonized System (HS) code for powdered buttermilk to be 0403.90.11.00.

Step 2: Determine the value of goods

Next, the food company needs to determine the “value for duty,” which represents the base figure used by the Canada Border Services Agency (CBSA) to calculate any duty and taxes owed on imported goods.

Although the CBSA provides several methods for valuing goods, the Transaction Value Method is the most commonly used. This method is based on the “price paid or payable” for the goods, which means it uses the actual price the importer paid for the goods as the starting point for valuation.

The “price paid or payable” is established using the commercial invoice and Form B3. Businesses should note that the goods’ value for customs should include the cost, insurance, and freight (CIF) to Canada, and it is crucial to ensure the value is expressed in Canadian dollars (CAD).

Returning to our example, the food company determined the value of goods as follows:

- Commercial invoice value: The value of the powdered buttermilk is CAD$10,000.

- Freight & insurance cost: Let’s say it costs CAD$1,000 for shipping and insurance.

So, the total cost = (CAD$10,000 + CAD$1,000) = CAD$11,000.

Step 3: Determine the applicable rates of duty

Now that the food company has obtained the HS Code and completed the valuation, they can use an online duty calculator or consult the Customs Tariff to find out the duty rate applicable to their goods.

Given that goods originating from China do not benefit from preferential tariff rates, the normal rate (aka. of the most favored nation rate) will be applied. Upon consulting the Customs Tariff table, the food company determines the following:

- Duty rate: The duty rate for powdered buttermilk is 3.32¢/kg, which is a specific rate (calculated based on the designated unit of imports) as opposed to the more commonly used ad-valorem duty (based on the value for duty)

- Weight of goods: For this example, let’s say we have 2,000 kilograms of powdered buttermilk.

- Duty calculation: Duty = 2,000 kg * 3.32¢/kg = 6,640¢ or CAD$66.40.

Step 4: Calculate the applicable Customs taxes

When importing commercial goods into Canada, businesses should know that their products are subject to Goods and Services Tax (GST), Provincial Sales Tax (PST), or Harmonized Sales Tax (HST).

- GST: 5% applied on most imported goods.

- PST: Varies by province; some provinces apply this in addition to GST.

- HST: A combination of GST and PST, applied in certain provinces at varying rates from 13% to 15%.

In our example, powdered buttermilk is subject to the Goods and Services Tax (GST) at a rate of 5% and to Quebec Sales Tax (QST) at a rate of 9.975%.

- GST Calculation: (Value of goods + Duties ) * 5% = (CAD$11,000 + CAD$66.40) * 5% = CAD$553.32.

- Total after GST: (CAD$11,000 + CAD$66.40 + CAD$553.32) = CAD$11,619.72.

- QST Calculation: CAD$11,619.72 * 9.975% ≈ CAD$1,159.07.

- Total taxes: CAD$553.32 + CAD$1,159.07 = CAD$1,712.39.

Step 5: Calculate additional levies and fees

In addition to import duties and taxes, businesses should consider the following costs:

- Excise taxes and duties: May apply to specific products like alcohol, tobacco, and fuel.

- Customs handling fees: These are for handling and processing the imported goods through customs.

- Environmental levies: Applicable on certain products like electronics and tires for recycling programs.

In our example, there are neither excise taxes nor environmental fees that typically apply to food products such as powdered buttermilk. Therefore, the only additional cost that the food company will incur is the handling fees charged by Customs authorities. For this example, we’ll assume a fee of CAD$200.

Step 6: Final duty and tax calculation

The final amount that the food company can expect to pay for importing powdered buttermilk into Canada will include the following:

- Value of goods: CAD$11,000;

- Duty payable: CAD$66.40;

- Taxes payable (GST + QST): CAD$1,712.39;

- Customs handling fees: CAD$200;

- Total cost: CAD$11,000 + CAD$66.40 + CAD$1,712.39 + CAD$200 = CAD$12,978.79.

Please remember that this is an illustrative example. In practice, companies should seek advice from customs brokers, consultants, or directly from the Canada Border Services Agency (CBSA) to ensure accuracy in their customs declarations and payments.

4. Arrange for the shipping

Once businesses have prepared the necessary shipping documentation and estimated the appropriate customs duties and taxes for importing goods from China to Canada, the next crucial step in the import process is determining the most suitable method of transportation.

Businesses can choose between air or ocean freight and then select local road or rail solutions for last-mile delivery within the Canadian border. Below is an overview of the available shipping options for sea or air shipping.

4.1 Sea freight

LCL (Less than Container Load)

- Best used when: The shipment doesn’t fill an entire container.

- Description: This method allows for shipping smaller amounts of cargo without the cost of an entire container. The goods will be consolidated with other shipments, and costs are generally based on volume.

FCL (Full Container Load)

- Best used when: Businesses have enough goods to fill a whole container.

- Description: FCL provides businesses with a dedicated container for their shipment. It is ideal for large quantities and can be more cost-effective when shipping at high volumes. FCL also tends to be faster than LCL since there’s no need to consolidate goods from different shippers.

4.2 Air freight

Classic Air Freight

- Best used when: Businesses require a balance between speed and cost.

- Description: Classic air freight is typically faster than sea transport but more expensive. It is suitable for goods that are too urgent to go by sea yet not so critical to incur the high cost of express service.

- Best used when: The shipment is urgent.

- Description: This is the fastest shipping method with the shortest transit times. It is the best option for time-sensitive goods. Express air freight often comes with premium services like door-to-door delivery and is typically the most expensive option.

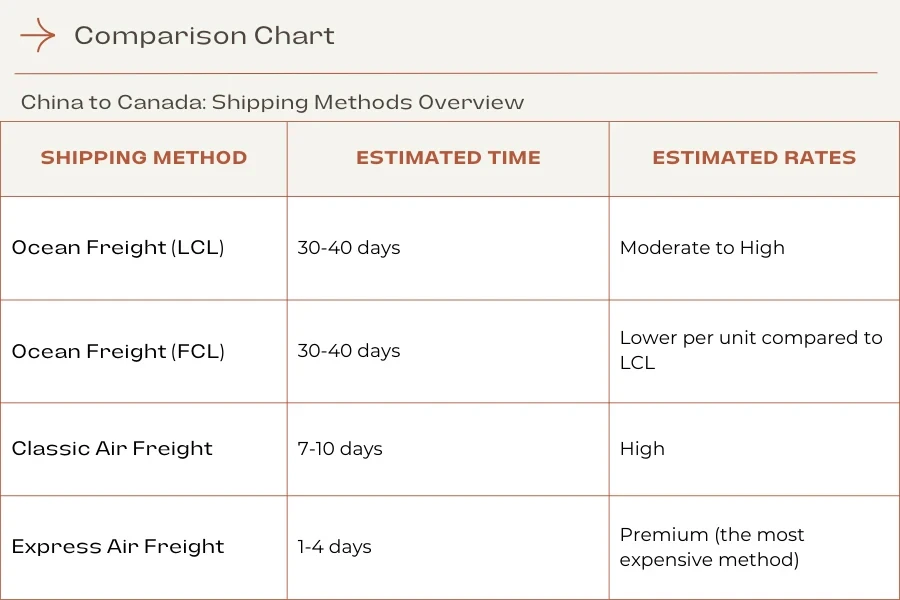

The table below offers a summary of the various shipping methods from China to Canada, highlighting their estimated times and costs:

For accurate quotes and shipping times from China to Canada, visit the Alibaba.com Logistics Marketplace to compare prices and book shipments with leading freight forwarders.

5. Report and release the goods

The final step of the import process is Customs clearance, which occurs when the goods arrive at the Canadian border. In this step, businesses are required to complete and submit the B3-3 (Canada Customs Coding Form) discussed during the preparation of shipping documentation (Step 2) and pay the duties and taxes previously estimated (Step 3) to clear the imported goods through customs.

Some CBSA offices offer a self-service computer-based system, the Commercial Cash Entry Processing System (CCEPS), which assists businesses in completing the B3-3 coding form and automatically calculates the duties and taxes owed. For detailed guidance on how to fill out the B3-3 form, refer to Memorandum D17-1-10.

Additionally, businesses must provide the CBSA with the following documents prepared during (Step 2):

- Two copies of the Cargo Control Document (CCD);

- Two copies of the Canada Customs Invoice (or the commercial invoice that contains the data);

- A paper copy of all import permits, certificates, licenses, etc.

It should be noted that established importers with high import volumes can have their imported goods released before the payment of duties by obtaining a Release on Minimum Documentation (RMD).

RMD enables importers to have their goods released before the full payment of duties by simply providing interim accounting data. Businesses can then complete detailed accounting and make final payments later within designated timeframes. Upon clearance, the goods can be transported inland to their final destination, such as the importer’s warehouse facility.

Simply the process of importing to Canada with Customs brokers

To wrap it up, importing from China to Canada involves five main steps:

- Securing necessary permits and ensuring goods are allowed for import;

- Preparing shipping documents, including a certificate of origin;

- Calculating import duties and taxes based on the goods’ value, classification, and origin;

- Choosing and arranging a shipping method;

- Finally, reporting the goods to the CBSA for release.

While businesses can choose to handle the import process independently, opting to partner with a CBSA-licensed customs broker to manage all these steps on their behalf is another efficient option. Customs brokers, with their deep knowledge of tariff classifications and other customs affairs, can accurately calculate the import duties and taxes that a business will be liable for, potentially saving businesses from costly mistakes and overpayments.

However, it is crucial to note that importers who delegate these responsibilities to a broker still retain responsibility for the accuracy and completeness of their import documentation. This is why understanding the import process is recommended so that businesses can collaborate effectively with customs brokers and the CBSA to ensure full compliance with all Canadian import requirements.

To learn more about customs brokers and how to select one that meets your import needs, check out this guide!

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.