With a rising middle class and increasing consumer spending that reached an estimated USD 169.03 billion in the third quarter of 2023, it is no wonder that South Africa has become an attractive market for importers. Moreover, South Africans are eager to purchase foreign goods as South Africa’s total imports in 2022 amounted to USD 127.75 billion. That’s nearly a 21.76% increase compared to 2021.

However, this growing consumer market is not the only reason that makes the Rainbow Nation a strategic destination for importers. Here are some other reasons why businesses should start importing goods into South Africa:

- Strategic location: The country is at the tip of the African continent with various ports facilitating import access to African markets.

- Developed infrastructure: South Africa has developed an interconnected network of well-maintained roads, extensive railway lines, and large seaports.

- Established legal framework: The country continues to develop encouraging and systematic laws that regulate imports, support trade policies, and protect importers/exporters.

- Advanced banking sector: The banking system in South Africa is well-developed and supports e-commerce transactions, including foreign currency trade and secure payments.

So, how can businesses start importing goods into South Africa? Which permits or licenses should importers obtain? What are the applicable rates of duty? And how can importers ensure their goods are cleared through customs without incurring delays or penalties?

Continue reading to find answers to all these questions as we break up the entire process of importing from China into South Africa into just six easy steps!

Table of Contents

1. Determine the goods to be imported

2. Register as an importer and obtain import permits

3. Identify tariff codes and applicable duty rates

4. Calculate the total cost of importing

5. Arrange for the shipment of goods

6. Prepare import documentation to clear goods

7. Streamline the import process with Customs brokers

1. Determine the goods to be imported

The first step for importers, before handling any paperwork or calculating duties, is to choose the goods they plan to bring into South Africa. The good news for aspiring importers is that Chinese goods already account for almost 20% of South Africa’s total imports.

In terms of industrial goods, the Rainbow Nation is focusing its investments and growth plans on specific strategic sectors. These include the renewable energy, the oil and gas supplies and equipment, and the medical equipment and healthcare sectors.

The top industrial imports of South Africa can be classified as follows:

- Refined petroleum (15.2% of total imports);

- Cars (4.1% of total imports);

- Crude petroleum (3.84% of total imports);

- Motor vehicles, parts, and accessories (3.33% of total imports);

- Broadcasting equipment (2.76% of total imports).

“What about consumer goods?” importers might wonder. Well, as discussed in the introduction of this blog, South African consumers are willing to buy a wide range of foreign goods. However, there has been a growing consumption shift towards health and sustainability-focused products in recent years.

Here is a list of the top consumer goods in South Africa:

- Food products: Food items represent a major part of consumer spending in South Africa. Besides basic groceries, South African shoppers are seeking health-oriented or organic foods.

- Healthcare and hygiene products: As South African consumers continue to prioritize health, there is a surge in demand for medications, supplements, and personal hygiene items.

- Technology products: South Africa, like much of the world, has a high demand for smartphones and mobile devices. Computers and their accessories are also on the shopping list.

- Automotive products: South African consumers show a particular interest in both new and used cars. Consequently, auto parts and accessories are also in high demand.

- Apparel and footwear: From discount and value-oriented products to high-end designer labels, South African shoppers are particularly interested in fashion and footwear.

- Household products: The hygiene awareness of South African consumers will continue to drive demand for cleaning products and household furnishings.

Once importers have decided on the goods they want to import to South Africa, the next step is to find reliable suppliers in China. Luckily, this is the easiest part. Businesses can simply visit Alibaba.com, one of the largest online B2B marketplaces in the world.

There, they can source millions of products from over 200,000 leading suppliers. Check out this comprehensive guide to learn how to source from Alibaba.com without making beginner mistakes!

2. Register as an importer and obtain import permits

Now, it’s time for some paperwork. Before businesses can import anything to South Africa, they need to register as an importer with the South African Revenue Service (SARS). Moreover, foreign importers must nominate a registered local agent to act on their behalf during the import process.

While this might seem like an off-putting requirement, it is simply an additional layer to ensure that there is a local representative in South Africa who is accountable for all customs-related matters. Click here for more details on how to register as an importer with the SARS.

After registering as an importer, it’s time to ensure that the goods are permitted for entry into the South African market. Certain goods are banned from entering South Africa under any circumstances. Examples of such prohibited items include narcotics, military weapons, explosives, poison, and other toxic substances.

While some general consumer goods can be imported without restrictions, most goods require an import permit from the International Trade Administration Commission (ITAC). Certain categories of products even require additional licenses or certificates from other governmental departments.

For instance, to import animal products such as meat, poultry, and egg products, businesses need to obtain sanitary or phytosanitary certificates from the Department of Agriculture, Forestry, and Fisheries (DAFF) to ensure they are safe, wholesome, and properly labeled.

Click here for more details on how to apply for a permit depending on the category of imported goods. Businesses can find which departments they need to contact, the forms they need to complete, and how long it will take for the permit to be issued. Click here for a comprehensive list of prohibited and restricted goods.

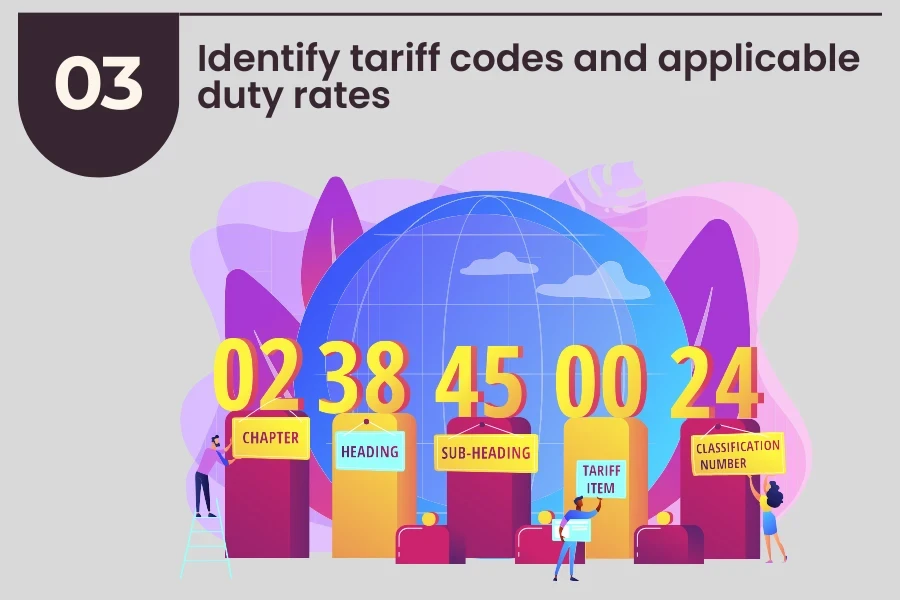

3. Identify tariff codes and applicable duty rates

After securing all the necessary permits and licenses, the next step is to determine the correct Harmonized System (HS) codes for the imported goods. This step is error-prone as it requires a certain degree of knowledge and expertise. Assigning the incorrect HS code may lead to overpayment or underpayment of customs duties. Even worse, the importer may face penalties from the customs authorities.

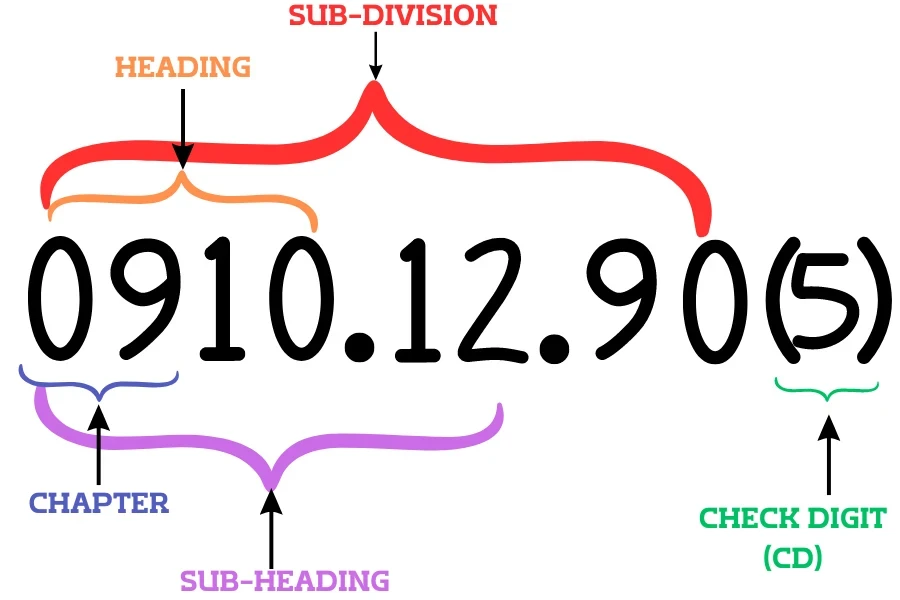

Here is what importers should know about HS codes when importing goods into South Africa. The HS code generally consists of up to 9 digits. The first 6 digits are standardized by the World Customs Organization (WCO) and are used internationally. The additional digits (7th, 8th, and 9th) are specific to South Africa for applying specific taxes, imposing import quotas, or just for the sake of conducting statistical tracking.

Here is a breakdown of an HS code when importing goods into South Africa:

- First 2 digits (Chapter): The first two digits refer to the chapter under which the product is categorized. For example, “09” is for “Coffee, Tea, Mate & Spices.”

- Next 2 digits (Heading): The next two digits provide more details about the type of products covered within the chapter. For example, “0910” would refer to products like ginger, saffron, turmeric, and other similar spices.

- Next 2 digits (Sub-heading): The 5th and 6th digits provide a more detailed classification of the product. For example, “0910.12” might refer to turmeric.

- Next 2 digits (Sub-division): South Africa uses the 7th and 8th digits to provide a more specific classification within the sub-heading. “0910.12.90” might refer to a particular type of turmeric prepared in a certain way.

- 9th check digit (CD): South Africa adds this 9th digit as a check digit to validate the code and prevent errors in data entry during customs clearance.

Now that importers understand the basic structure of HS codes, let’s see how they can determine the correct HS code for their imported goods according to South African rules.

Step 1: Consult Schedules of the Customs and Excise Act

First, importers need to check the Schedules of the Customs and Excise Act. There, businesses can find 8 schedules (numbered 1 to 6, 8 and 10) covering customs duties, excise duties, rebates, and environmental levies.

Step 2: Consult Schedule 1, Part 1, Chapters 1-99

For the majority of imported goods, importers will need to check Schedule No. 1, which is related to ordinary customs duties.

Step 3: Look up the full HS code

Next, importers should identify the heading under which their product falls by using the first 6 digits of the product’s HS code. Businesses can obtain these 6 digits directly from their suppliers, who may have past experience exporting the same product, or they can use a free online tool like FindHS. Finally, importers should take note of the complete South African HS code of their product in the table. For instance, the HS code of “Slide fastener chains or stringers” is “9607.20.50.”

Step 4: Determine the applicable rate of duty

Once importers have the HS code of their imported goods, they need to determine the applicable duty rate. Goods originating from China don’t benefit from preferential rates. To find the duty rate of Chinese goods, refer to the sub-column titled “General” under the column “Rate of Duty.” For example, in the case of “Slide fastener chains or stringers,” the applicable general duty rate is 20%.

4. Calculate the total cost of importing

Now that importers have identified the tariff code of their imported goods and their applicable duty rates, it’s time to crunch some numbers to estimate the total importing costs (aka import duties, taxes and fees) to South Africa.

Let’s use the same example of “Slide fastener chains or stringers” and assume that an automotive supplier is importing slide fastener chains from China. For those who wonder, stringers are zipper components found in the soft tops of convertible cars and some interior covers.

Let’s go through the calculation process step by step:

Step 1: Determine the customs value

South African customs authorities use the FOB (free on board) price in the country of export as the basis to determine the transaction value for imports. This value covers the charges incurred up to the point where the goods are loaded on the vessel, including the cost of the goods, packing costs, transportation, and loading fees.

Generally, international shipping and insurance costs are excluded from this transactional value. Let’s assume that the FOB price of the slide fastener chains in our example is USD 1,000. This will be the customs value for our subsequent calculations.

Step 2: Add a 10% markup (if applicable)

It’s important to note that a 10% markup is applied to the customs value when goods are imported from countries outside the BLNS Union (Botswana, Lesotho, Namibia, or Swaziland).

Since the slide fastener chains in our example are imported from China, we will apply a 10% markup. If the customs value is USD 1,000, the markup will be USD 1,000 x 10% = USD 100. So, the marked-up customs value would be USD 1,100.

Step 3: Calculate the customs duties

Importers should know that there are two methods by which customs duties can be calculated:

- Ad-valorem calculation: In this method, duties are calculated as a percentage of the customs value.

- Specific calculation: In this method, duties are calculated based on the quantity of goods (e.g., cents per kilogram).

In our example, we know that the applicable duty rate for slide fastener chains is 20%. So, we will need to use the Ad-valorem method. Since the marked-up customs value is USD 1,100, the calculation will be USD 1,100 x 20% = USD 220.

Step 4: Calculate the added tax value (ATV)

We should now determine the added tax value (ATV), which is the total dutiable value. We simply need to combine the customs value, the customs duties, and the 10% markup. Using the previous figures, this would be USD 1,100 + USD 220 = USD 1,320.

Step 5: Calculate the value-added tax (VAT)

The current VAT rate in South Africa is 15%. So, if the ATV is USD 1,320, the calculation will be USD 1,320 x 15% = USD 198.

Step 6: Sum all the costs

To determine the total cost of importing slide fastener chains from China into South Africa, we need to combine all the costs from the previous calculations. In our example, the total would be:

- Marked-up customs value: USD 1,100

- Duty payable: USD 220

- VAT payable: USD 198

- Total cost: USD 1,518

Please note that, for the sake of simplification, other costs have been excluded. These additional costs could include:

- Shipping and insurance costs: These are the charges incurred for transporting the goods and the premiums paid to cover the risk of loss or damage.

- Excise duties: These taxes are levied on specific goods (e.g., alcohol, tobacco, and fuels) to reduce their consumption in the destination country.

- Anti-dumping duties: These tariffs are imposed on imported goods if Customs authorities believe their price is below fair market value.

- Countervailing duties: These duties are imposed on goods originating from certain countries. The purpose is to offset the subsidies provided by foreign governments to exporters.

- Environmental levies: These taxes are imposed on goods that produce carbon emissions during their manufacture.

5. Arrange for the shipment of goods

At this stage of the import process, businesses should start arranging the shipping method. Given the long distance between China and South Africa, importers generally have the following shipping options:

1. Ocean freight

- Less than Container Load (LCL): In LCL shipping, the imported goods do not fill an entire container; instead, they are shipped alongside other consignments.

- Full Container Load (FCL): In FCL shipping, the goods fill one (or more) entire container on the vessel. Unlike LCL, the container is shipped directly without the need to unload and organize goods with other shipments.

2. Air freight

- Classic air freight: In this shipping option, goods are transported on cargo planes and sometimes on regular passenger flights.

- Express air freight: This shipping option is the fastest because it employs express courier services for door-to-door delivery with minimal transit time.

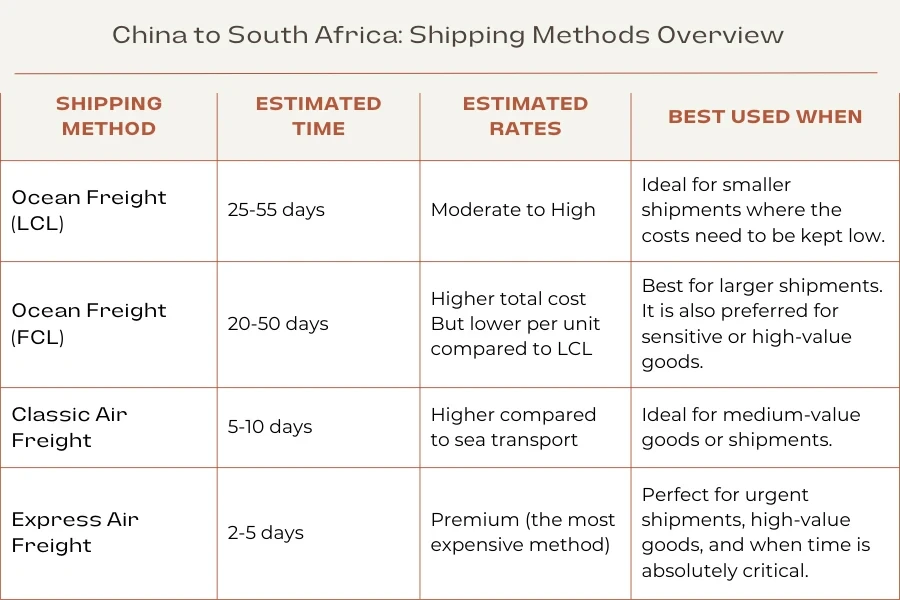

Importers can refer to the table below for an overview of the different shipping methods, their estimated times and rates, and the best scenarios for using each:

For accurate shipping quotes and transit times from China to South Africa, importers can visit the Alibaba.com Logistics Marketplace to compare the prices of shipment solutions (including door-to-door and port-to-port services) from leading freight forwarders.

6. Prepare import documentation to clear goods

The final step of the import process is the preparation of the necessary paperwork required by customs authorities to evaluate and clear goods for entry into South Africa. Importers have the option to submit their paperwork either in hardcopy at the front office of the South African Revenue Service (SARS) or digitally using e@syscan, a software package developed by SARS for document scanning.

The table below provides a non-exhaustive overview of the shipping documentation and declaration forms required by the SARS to clear goods:

| Document | Description |

| Customs Clearance Declaration (CCD) | Every importer of goods must lodge a CCD (also known as the SAD 500 form). This form includes detailed information about the importer, the type and value of imported goods, the country of origin, and the customs office of entry and exit. For more details on how to complete the CCD form, refer to the external annex “Completion of Declarations” included in the SF-CF-55 – Clearance Declaration Policy. |

| Commercial invoice | This bill is issued by the exporter to the importer. It details the |

| Certificates, declarations, or permits | These are the proof documents obtained during Step 2-‘Register as an importer and obtain import permits.’ These documents serve as validation that the goods are permitted for import and meet all regulatory requirements set by the South African authorities. |

| Packing list | This shipping document lists each item in the consignment, along with its type, quantity, and weight or dimensions. Customs authorities may use this document to ensure that the contents of the unloaded cargo correspond exactly to those described in the list. |

| Bill of Lading (BOL) or Air Waybill (AWB) | These transportation documents (BOL for sea freight and AWB for air freight) act as both a contract and receipt between the shipper and the freight carrier. These documents detail the terms of transportation and provide proof of who owns the shipped goods. |

| Covering statement | This document is simply a comprehensive financial summary provided by the shipper of goods. It states the total invoiced selling prices listed on all the suppliers’ commercial invoices, along with all additional charges and commissions. These extra costs include but are not limited to, freight and marine insurance fees associated with the shipment. |

Click here to check the comprehensive list of documents required by SARS for customs clearance.

Streamline the import process with Customs brokers

Once importers have paid all applicable duties and taxes and have presented the required clearance documentation, SARS will release the imported goods. Importers can then collect their goods from the seaport/airport or have them delivered by their freight forwarder to a designated warehouse for later distribution within the country.

That’s it. We have broken the entire process of importing goods from China into South Africa into just 6 steps. For beginner importers who still find this import process overwhelming, it’s best to hire customs brokers located in South Africa. Also, don’t forget to check this practical guide for importers.

Besides their in-depth knowledge of customs paperwork and regulations, local customs brokers are likely to have established relationships with the South African Revenue Service (SARS). Thus, they can minimize the risk of delays or non-compliance.

Check this guide to learn more about customs brokers and how to select the ideal one!

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.