The United Kingdom (UK) represents a lucrative market for importing a broad spectrum of products, from luxury goods to everyday items. Its consumer base boasts considerable purchasing power, with domestic consumption expenditure reaching approximately USD 1.894 trillion in 2022. This figure is nearly equivalent to the entire household consumption expenditure of Africa in 2021.

Moreover, the UK has one of the most advanced e-commerce markets in the world, with a significant portion of consumer shopping occurring online. This enables international businesses to sell imported goods without establishing a physical presence in the UK. Therefore, it’s not surprising that the value of total goods imported into the UK in the 12 months leading up to January 2024 amounted to about USD 1.204 trillion.

However, the process of importing goods into the UK involves a lot of complex operations and documentation, from planning and arranging for the transportation of goods to preparing and submitting shipping documents to meet the UK’s customs requirements.

Furthermore, since the UK decided to leave the European Union, commonly known as Brexit, new customs checks, trade agreements, and a significant increase in the required paperwork have been introduced.

But no worries! Continue reading as we simplify the entire process of importing goods from China into the UK in this blog post, breaking it down into just five easy steps!

Table of Contents

1. Why should businesses import goods from China?

2. Import goods from China into the UK in 5 steps

3. Simplify the import process to the UK with customs brokers

Why should businesses import goods from China?

Before exploring the five-step process of importing goods from China into the UK, one might ask, “Why import from China in the first place?” Below are four reasons that make China an attractive source of products for global companies:

Large manufacturing capacity

The primary reason China is considered a favorable source for businesses seeking to import goods is its recognition as the “world’s factory.” In 2021, China represented 30% of the global manufacturing output, and this figure grew to USD 4.98 trillion in 2022.

While for many years, the “Made in China” label was linked to mass-produced items of cheap and low quality, it has recently come to signify innovation, quality, and advanced manufacturing. This shift is attributed to the significant investments made by the Chinese government in technology sectors, including robotics, aerospace, and clean energy vehicles.

Low labor costs

Historically, low labor costs in China have been one of the primary factors attracting global companies to not only source and import goods from the country but also to relocate their production facilities.

While it’s true that labor costs in China have risen over the past few years, they generally remain lower than in most countries in Europe and North America. Low wages don’t necessarily suggest poor working conditions as they often relate to lower living costs. For example, living in China is 72% cheaper than in the United States.

Access to emerging technologies

China is also revolutionizing how products are designed and produced. China’s manufacturing sector has significantly invested in smart technologies that make factories more intelligent and interconnected.

Additionally, China is a global leader in the deployment of robotics and automation in manufacturing. Chinese smart factories also make use of 3D printing, facilitating rapid prototyping, efficient material use, and the creation of complex structures that traditional manufacturing methods cannot easily achieve.

These advancements provide global companies access to innovative technologies, ensuring precision, speed, and efficiency in production lines, ranging from consumer electronics to automobiles.

Robust and interconnected ecosystems

China’s status as a global hub for manufacturing and sourcing goods is not simply attributed to its skilled, affordable workforce or its massive manufacturing capacity. It’s also due to a well-developed business ecosystem in the country. This includes a robust network of suppliers, manufacturers, and logistics companies.

In addition, China is famous for its industrial clusters, which are geographically concentrated districts of interconnected companies, specialized suppliers, and service providers. Such an interconnected ecosystem ensures that each phase of the production chain, from sourcing raw materials through manufacturing to final delivery, is optimized for speed and cost-efficiency.

Import goods from China into the UK in 5 steps

Now that we understand why China is the go-to center for manufacturing and sourcing goods, let’s explore how businesses can begin importing goods from China into the UK in five steps:

1. Research the compliance of the imported goods

When importing goods from China into the UK, the initial step involves ensuring that the products comply with relevant UK regulations and standards. For most products intended for sale in Great Britain, the Department for Business and Trade (DBT) requires businesses to obtain one of two primary certifications:

- UKCA (UK Conformity Assessed): This conformity mark signifies that a product meets the regulatory requirements for sale within Great Britain (England, Scotland, and Wales). It covers most goods, including, but not limited to, toys, electronics, and construction products.

- CE Marking: This European Conformity mark indicates product compliance with all the applicable regulatory requirements of the European Union (EU) concerning health, safety, and environmental protection.

While the UK will continue to recognize the CE mark indefinitely for most goods placed on the market in Great Britain, the UKCA marking became mandatory post-Brexit for new products entering the GB market or when UK-specific regulations differ from EU standards.

It’s worth noting that additional certifications, safety assessments, or conformity declarations may be necessary for some products. For example, approval from the Medicines and Healthcare products Regulatory Agency (MHRA) is required for the importation of pharmaceuticals intended for human or veterinary use.

Furthermore, certain goods are restricted or entirely banned from being imported into the UK, regardless of whether they are sourced from China or elsewhere. For instance, the importation of controlled drugs, including narcotics and psychoactive substances, is prohibited under UK law.

2. Obtain necessary registrations and identifications

Once trading companies have verified that the goods intended for import adhere to all required British regulations and standards, the next step is to register for two key identifications, as mandated by the HM Revenue and Customs (HMRC):

2.1 EORI Number

Businesses are required to obtain an Economic Operator Registration and Identification (EORI) number to import goods into the UK. This unique identifier is assigned to both companies and individuals engaged in international trade with Europe, including the UK, after Brexit.

All traders need the UK version of this number to move goods into or out of Great Britain, Northern Ireland, or the Isle of Man, as well as between Great Britain and other countries. Having an EORI number is necessary for submitting customs declarations and obtaining clearances from the UK’s customs authority (HMRC).

2.2 VAT (optional)

In addition, it may be beneficial for businesses to register for VAT (Value Added Tax) if they wish to reclaim any VAT paid on imported goods. While VAT registration isn’t required for all importers, it could offer financial advantages for those who consistently incur VAT on imports.

As an example, imagine you’re importing electronics parts worth USD 100,000 into the UK, and you’re charged 20% VAT upon entry. This means you’d pay USD 20,000 in VAT. If you’re VAT-registered, you can reclaim this USD 20,000 in VAT on your VAT Return, provided that the goods are for business use.

3. Arrange the shipping method

Now that companies have obtained the necessary product certifications and ensured their business identifications are in order, the next step involves deciding how goods will physically make their way to the UK.

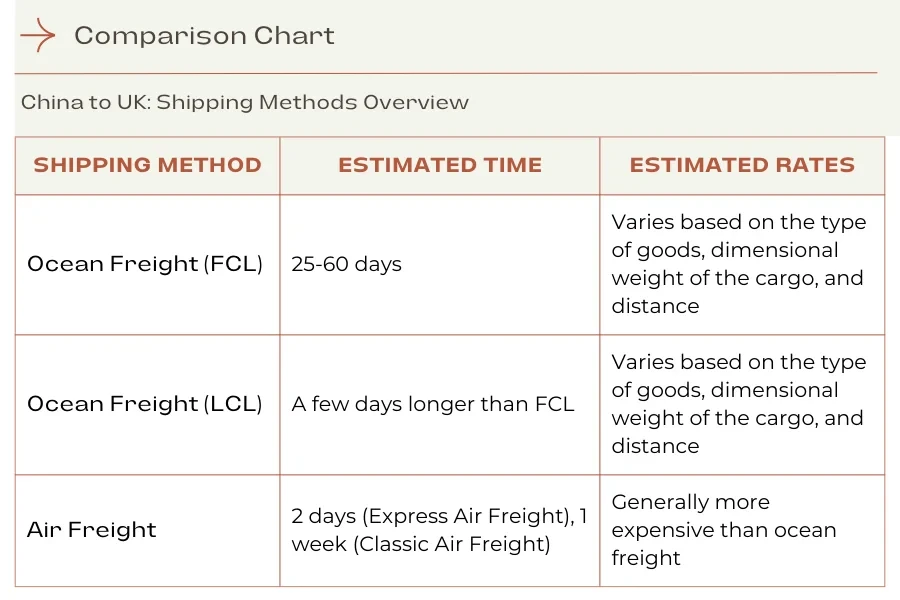

Typically, businesses can choose between air or ocean freight or opt for a combination of these methods with local road or rail solutions for last-mile delivery within the UK:

- Air transport: This is the quickest option for moving goods between China and the UK. It’s perfect for urgent or perishable items, ensuring they reach their destination in the shortest possible time. The trade-off for this speed is a higher cost, making it the most expensive transport method.

- Ocean transport: The most cost-effective choice for importing large, bulky, or heavy shipments from China. Although this method is considerably slower than air transport, it offers significant savings for non-time-sensitive cargo, making it ideal for large volumes.

- Multimodal or intermodal transport: These methods integrate various modes of transportation. For example, goods could be shipped via sea freight to a UK port, then followed by either rail or road transport to the final destination. This approach strikes a balance between time and cost, leveraging the cost-effectiveness of sea transport coupled with the precise, local delivery offered by road networks or rail systems.

The table below provides a summary of the different shipping methods from China to the UK, along with their estimated times and rates:

For accurate quotes and shipping times from China to the UK, considering the type of goods, along with their dimensions and weight, visit the Alibaba.com Logistics Marketplace. Here, businesses can connect with leading freight forwarders, compare various quotes, and explore a range of logistics services, including port-to-port and door-to-door services.

4. Prepare the shipment documents

Once the cargo space is booked with a freight forwarder and the goods are ready to be shipped from China to the UK, it’s time to prepare the necessary shipping documents. While the exact documents required may vary depending on the specific goods being imported, the following are typically required for all shipments:

- Commercial invoice: This document is a detailed bill provided by the exporter to the importer. It includes critical information such as the description of the goods, the total value for customs and insurance, quantity, weight, and terms of sale (e.g., Incoterms). The customs authorities use this document to determine the duties and taxes owed.

- Packing list: Accompanying the commercial invoice, the packing list itemizes the contents of each package or shipment. It details the types, quantities, and weights of the shipped products. This document helps in the check-in process at customs and assists with unpacking.

- Bill of Lading or Air Waybill:

- Bill of Lading (B/L) is used for ocean freight and acts as a contract between the owner of the goods and the carrier. It serves as a receipt for the shipped merchandise and can be used to claim the delivery of goods.

- Air Waybill (AWB) is the B/L equivalent used for air freight. It’s a contract of carriage that includes shipment tracking and proof of receipt.

- Certificate of Origin: It states where the goods were manufactured (or “originated”) and may be required for certain types of goods to determine the tariff rates or if the goods are legally permitted to be imported into the UK. Example categories requiring this document include agricultural products, textiles, and electronics.

- Import license: This is required for importing specific categories of goods that might be regulated or controlled. Examples of categories requiring an import license in the UK include firearms, plants, animals, and certain chemicals and pharmaceuticals.

- C88/SAD (Single Administrative Document) form: This is the main customs form used in international trade to or from the EU, including the UK. It details the movement of goods and serves as an official import declaration. The form is used to declare imports, exports, and goods transiting the UK, providing details such as the value, description, and origin of goods.

5. Pay import taxes and duties

Once the goods arrive in the UK, the final step is to pay import taxes and duties. Only after businesses have paid these charges can the goods legally clear customs, officially enter the UK, and be delivered to their final destination.

The HMRC evaluates the shipping documents from the previous step to assess the goods and determine the appropriate taxes and duties, which are based on the type, value, and origin of the goods.

To understand the process of tax and duty calculations, let’s imagine a scenario where a furniture company plans to import a batch of wooden chairs from China into the UK.

Step 1: Identify the commodity code (HS code)

A commodity code, or a harmonized system (HS) code, is a sequence of numbers used to classify goods for import and export within the UK and internationally. The furniture company can find the commodity code for wooden chairs by using HMRC’s Trade Tariff tool.

By inputting that the product is a chair made of wood, manufactured through carpentry they find the 10-digit HS code 9403 6010 00 for wooden chairs designed for dining.

Step 2: Calculate the value of goods

Next, the furniture company calculates the cost paid or payable for the goods. This value will be the base figure for calculating customs duty and import VAT.

- Estimated value of chairs: USD 5,000

- Shipping costs: USD 500

- Insurance: USD 100

Adding these together gives a total of USD 5,600.

Step 3: Choose CIF or FOB

After that, the company must decide which Incoterm to use for duty and tax purposes: CIF (Cost, Insurance, and Freight) if they intend to include shipping and insurance costs in the duty and tax calculation, or FOB (Free On Board) if they prefer not to include these costs.

In our example, the furniture company decides to go with CIF, meaning shipping and insurance costs are included in the duty calculation. This calculation aligns with our total of USD 5,600.

Step 4: Calculate import duty and VAT

Import duty:

The commodity code 9403 6010 00 has an assigned duty rate of 2%. (This rate is given for illustrative purposes in this example; businesses should confirm the current rates via the official HMRC website.)

Import duty = 2% of USD 5,600 = USD 112

VAT calculation:

VAT is calculated on the sum of the value of the goods plus any duties, taxes, and additional costs such as freight and insurance. First, we need to sum the cost of goods, shipping, insurance, and duty: USD 5,600 + USD 112 = USD 5,712

VAT is charged at a standard rate, which is 20% as of the last update (This can change, so always check the current VAT rate).

VAT = 20% of USD 5,712 = USD 1,142.40

So, to summarize:

- Total cost of goods (including CIF): USD 5,600

- Import duty: USD 112

- VAT: USD 1,142.40

- Total cost of importing: USD 5,600 (goods value + insurance + freight) + USD 112 (duty) + USD 1,142.40 (VAT) = USD 6,854.40

The furniture company in this example would expect to pay USD 6,854.40 to import the chairs into the UK.

Simplify the import process to the UK with customs brokers

To boil it down, the process of importing from China into the UK can be summarized in five key steps: researching product compliance, obtaining the necessary licenses and registrations, selecting a shipping method, preparing and submitting the required shipping documentation, and finally, paying duties and taxes to clear goods from customs.

A customs broker can assist importing companies by managing all these steps, thus making the workflow of transferring goods from China to the UK much smoother. In addition to their expertise in handling paperwork and navigating customs laws, customs brokers maintain regular communication with customs authorities and often employ electronic systems that can accelerate the clearance process.

Check out this guide to learn more about customs brokers and how to choose one that fits your import needs. So what are you waiting for? Get started by exploring the European Pavilion on Alibaba.com, where business buyers can source millions of EU and UK-certified products with just a click of a button from leading suppliers!

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.